#SustainabilityInTheBoardroom

Andreas Rasche is researching and teaching on corporate sustainability with a focus on ESG, governance and sustainable finance. He currently serves as the Associate Dean for the Full-Time MBA program at Copenhagen Business School. Andreas has published over 60 peer reviewed articles in international journals and authored/edited seven books. He has worked for and collaborated with the UN Global Compact on a number of projects. From 2012-2024, Andreas served as Associate Editor of Business Ethics Quarterly and was a Visiting Professor at Stockholm School of Economics (2017-2020). More at: http://www.arasche.com

06-02-2026

06-02-2026

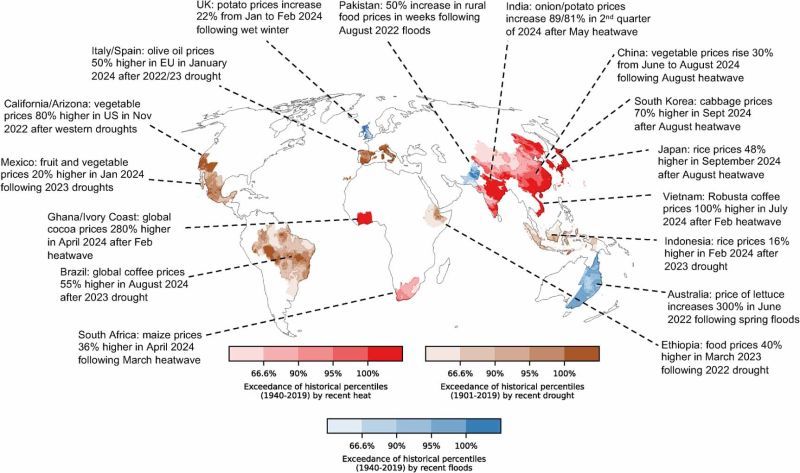

If a business has operations in a country that is more exposed to climate change, loans become more expensive, even if the firm hasn’t been hit by a disaster yet. Climate vulnerability raises loan costs by about 0.4% (on average).

This is precisely why many "descoped" firms cannot simply step back from climate-related reporting, even if they are exempted under the Omnibus. The expectations of banks, investors, and business partners are not easing, and neither are their risk models.

👉 Markets are adjusting to climate realities regardless of whether regulation is “simplified” or whether we believe there is a "backlash". For banks, it is a risk calculation. That's all.

===

The study analyzes ~86,000 syndicated bank loans issued to 9,251 firms across 77 countries.

06-02-2026

1️⃣ The key finding: when companies were required to disclose sustainability information, foreign institutional investors increased their investment. Clear ESG disclosure lowers information barriers for international investors, making companies more investable across borders. Interestingly, the effect was not observed for domestic investors.

2️⃣ The effect was strongest in those EU Member States where sustainability data had to be integrated into annual reports, making it easier to compare and connect ESG issues with financial performance.

And yet the #Omnibus I framed reporting almost exclusively as being about compliance costs, declaring reporting an enemy of competitiveness. Worth keeping in mind that such a perspective is short-sighted and too limited...

===

The study is based on an analysis of 602 EU firms and 2,292 non-EU benchmark firms. It was published in the latest issue of 'The Accounting Review'.

05-02-2026

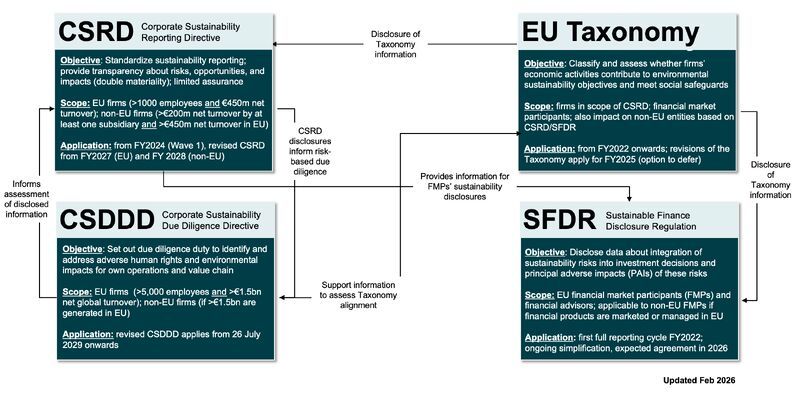

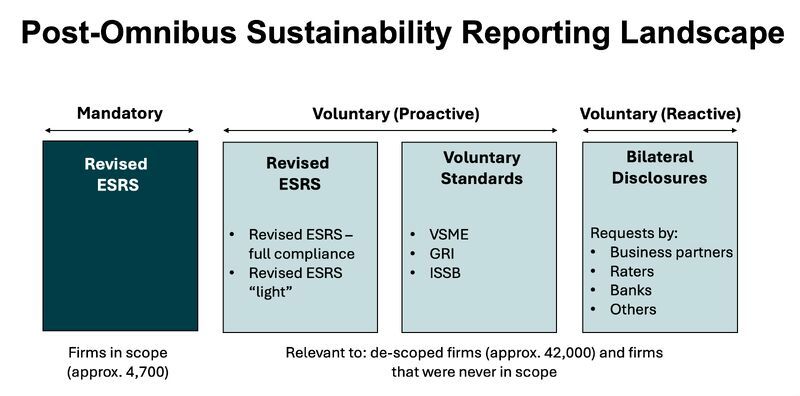

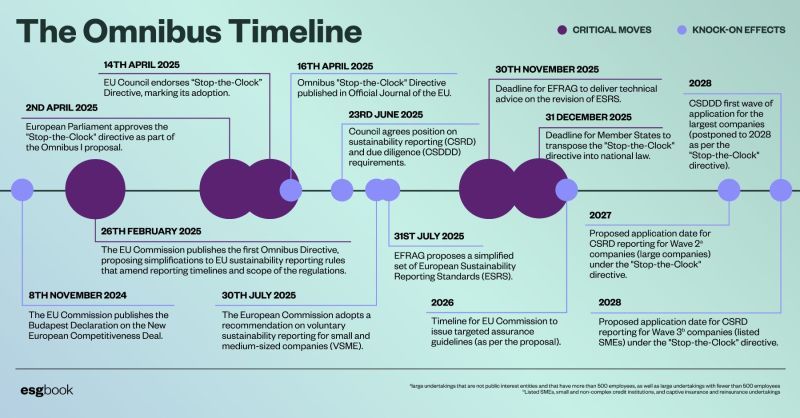

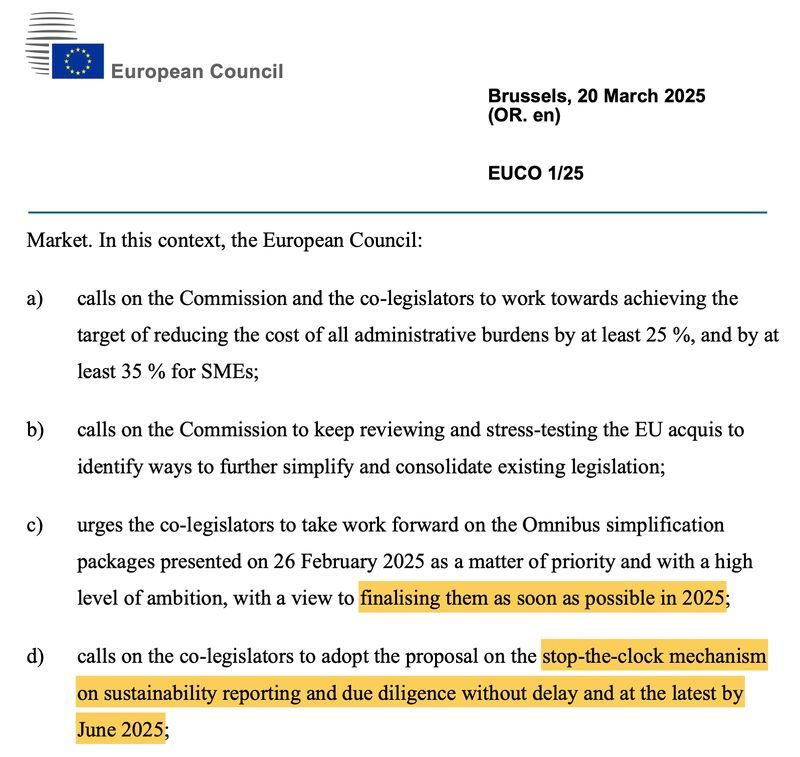

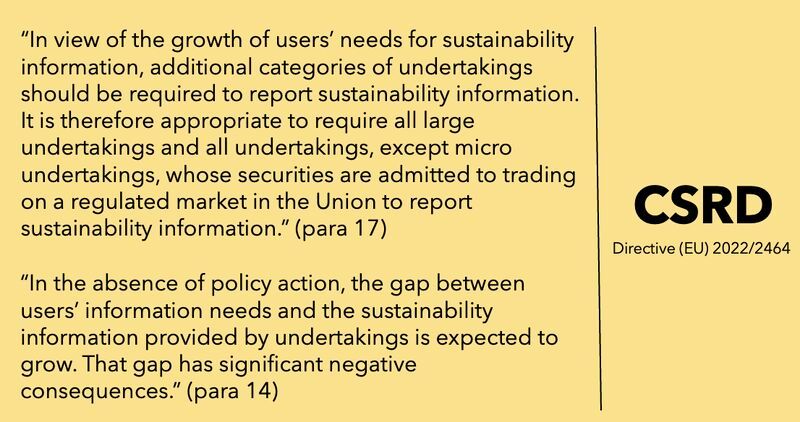

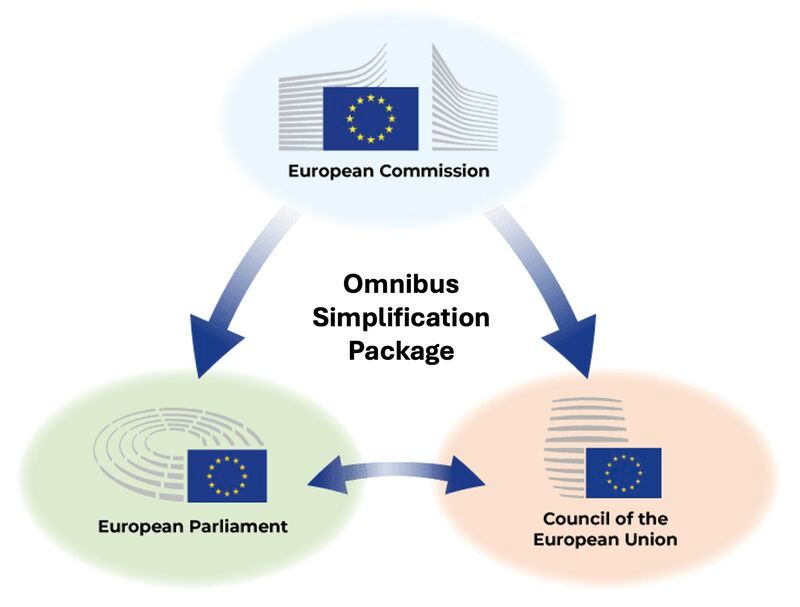

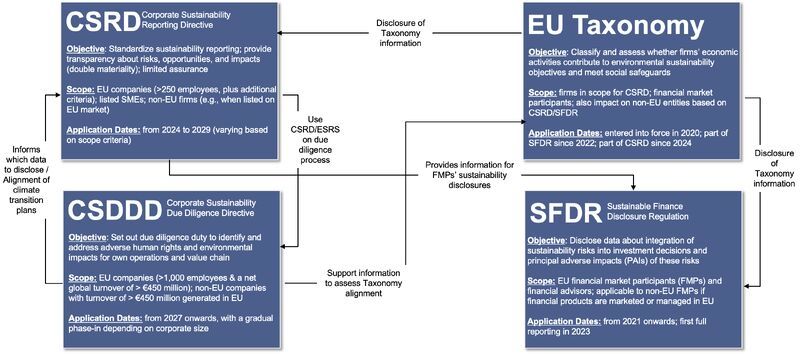

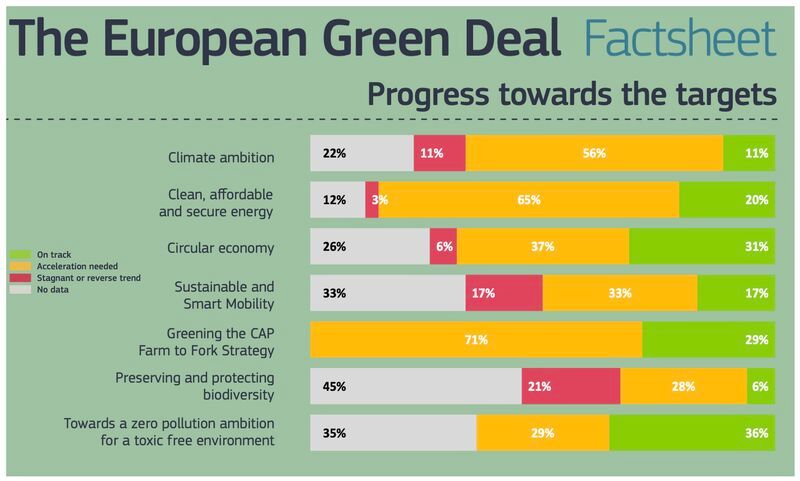

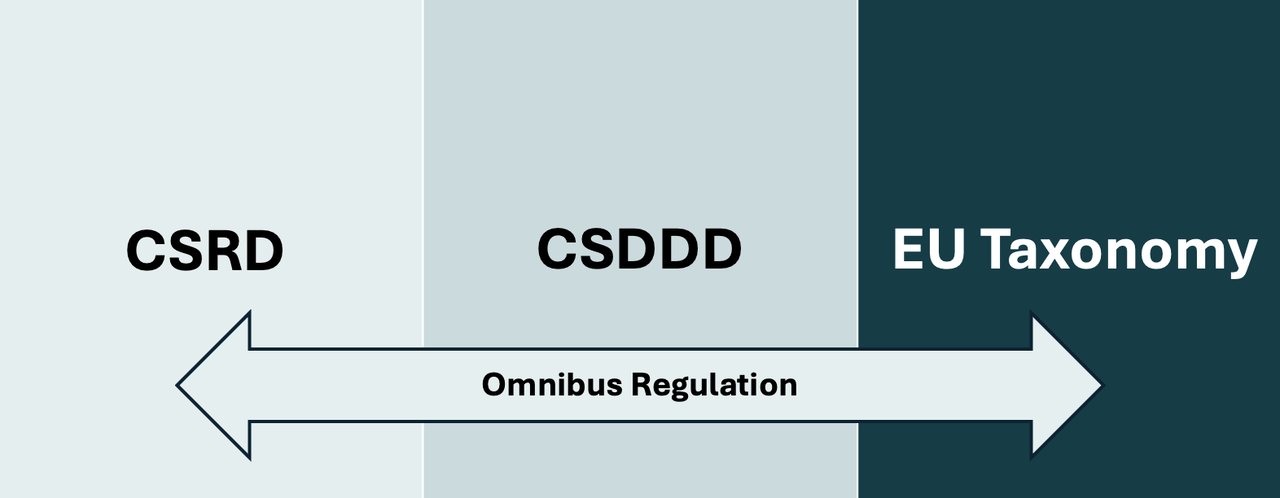

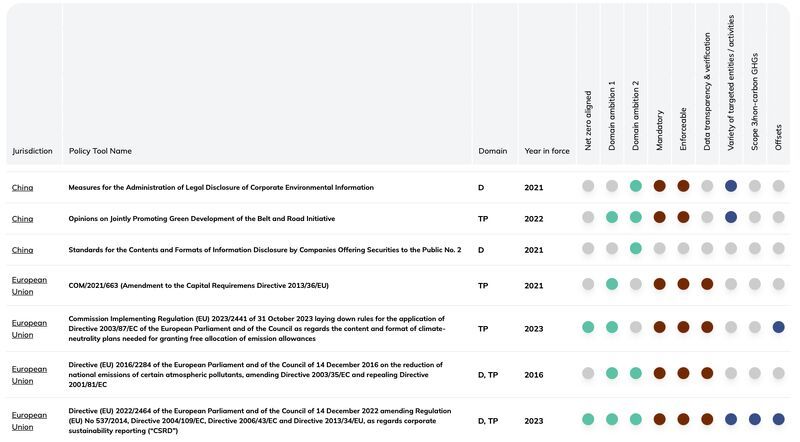

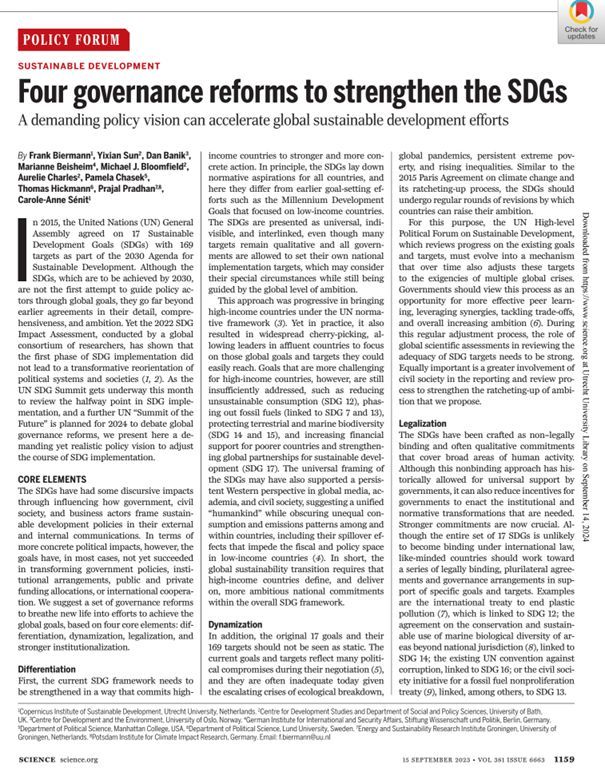

CSRD, CSDDD, the Taxonomy and SFDR were designed as an integrated system to deliver on the Green Deal. But the "simplified" system no longer has scale due to the heavy reduction in CSRD/CSDDD scope. It is therefore vital to scale back based on voluntary commitments.

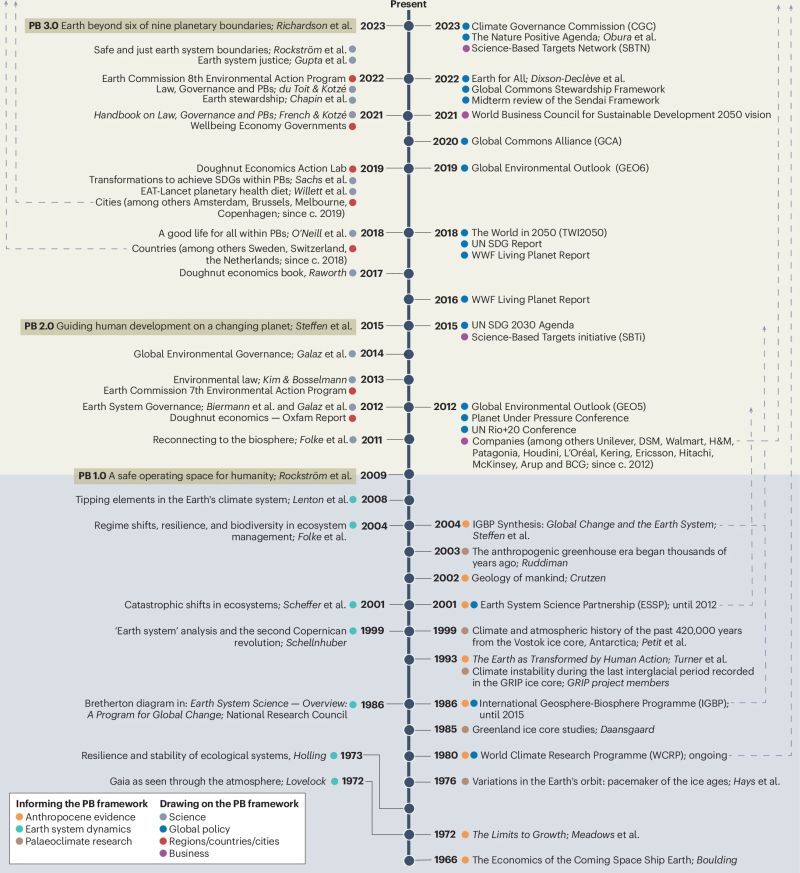

👉 Voluntary action requires understanding why these laws exist - their 'regulatory purpose'. Seeing the interconnectedness of regulations helps to exploring such purpose - e.g. you see where information flows and why business partners file disclosure requests.

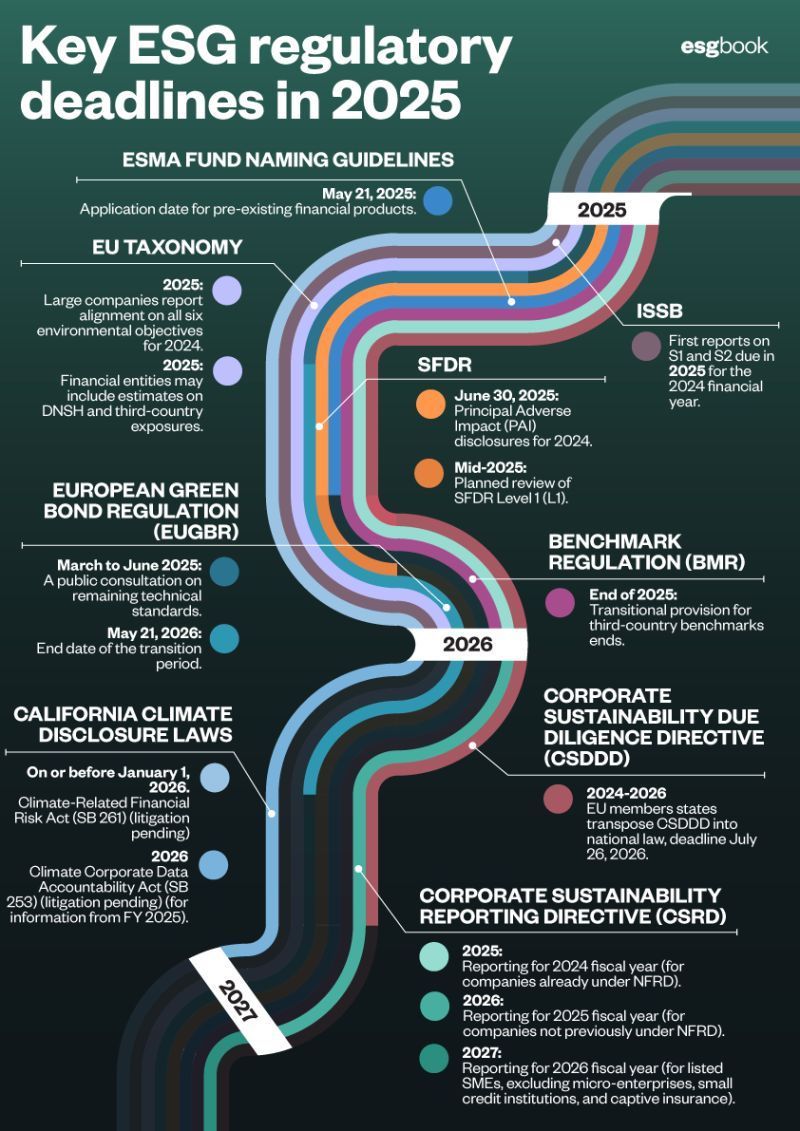

I use the updated figure below in my courses to help participants grasp the bigger picture before diving into details. Placing regulations in context avoids stereotypes (“reporting for reporting’s sake”) and, more importantly, shifts the focus beyond pure compliance.

03-02-2026

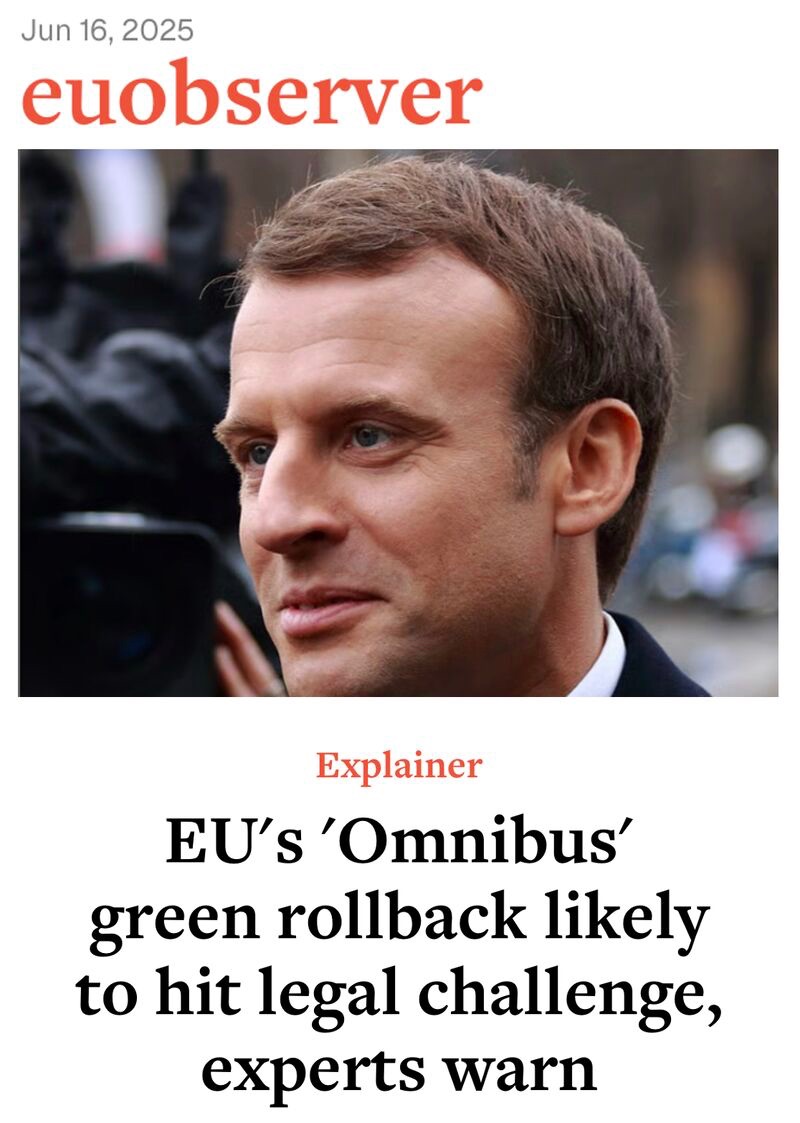

“I fully recognise that there are situations where swift action is necessary. But speed must not come at the expense of minimum procedural standards, because those standards are what ultimately guarantee predictability and trust.”

👉 Right now, the EU is operating in a fragile political and economic context. But it is precisely the "perception of fading legitimacy that can deepen and prolong these crises.”

Building simplification on clear guidelines and definitions is not bureaucracy for its own sake. It is about “predictability, enforcement, and trust – the foundations of a secure legal framework for business.”

02-02-2026

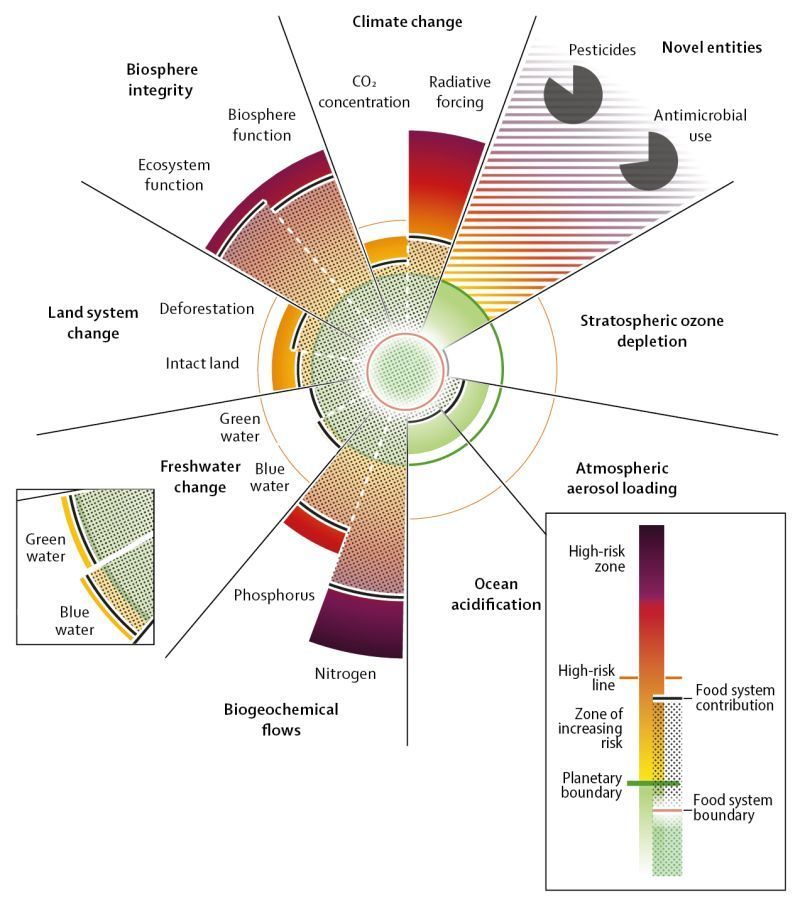

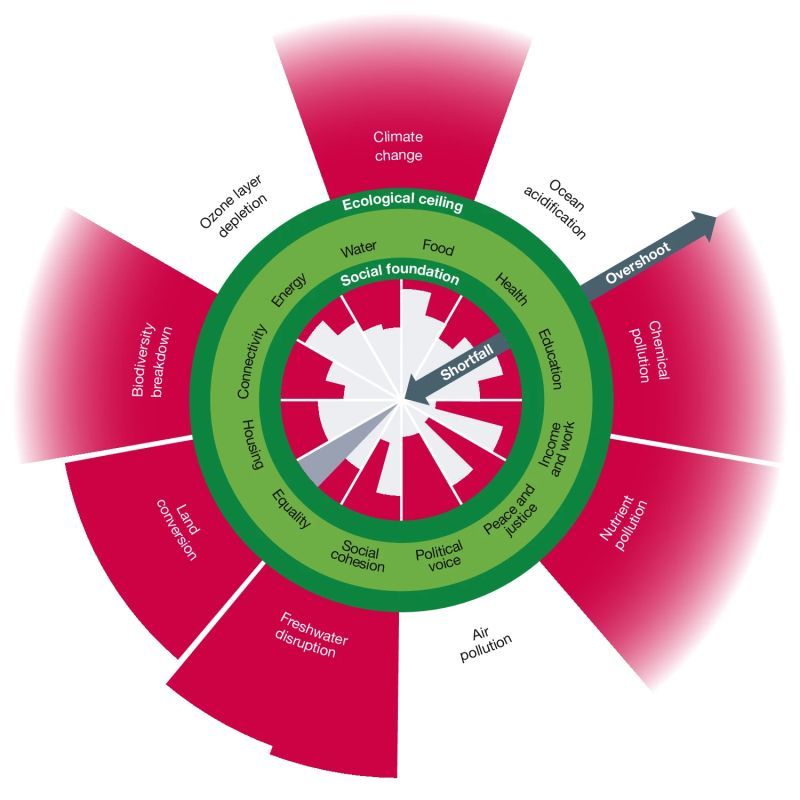

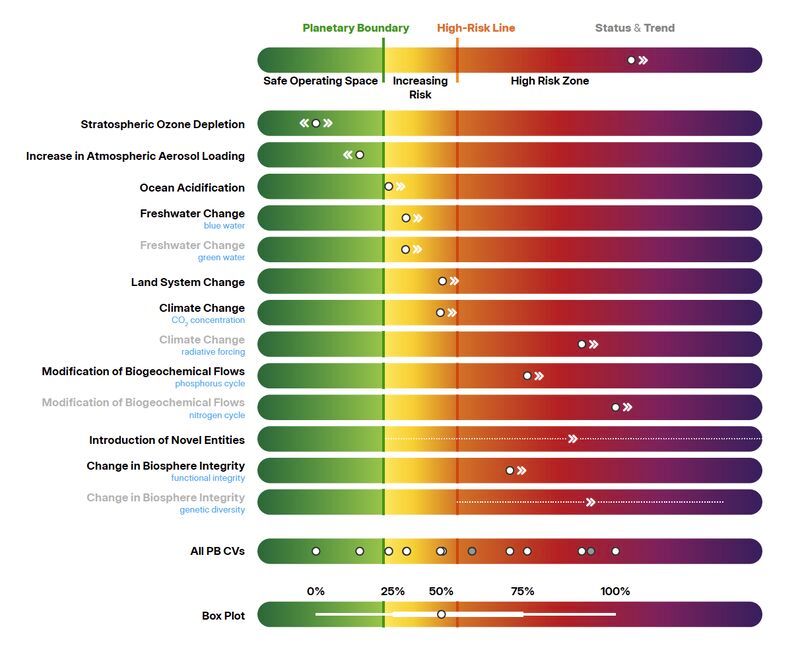

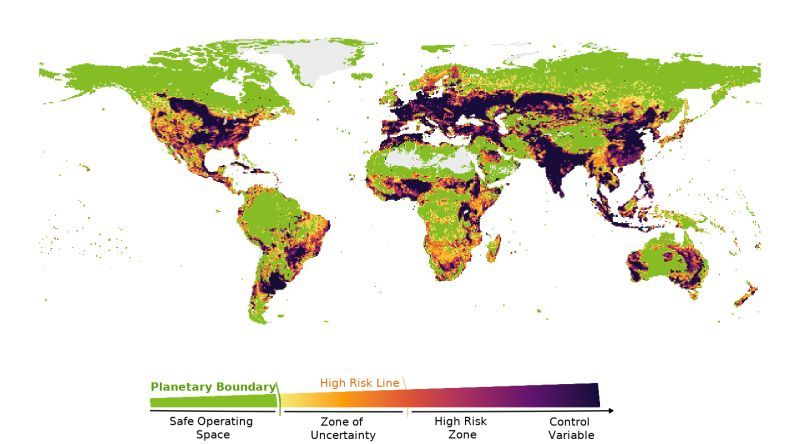

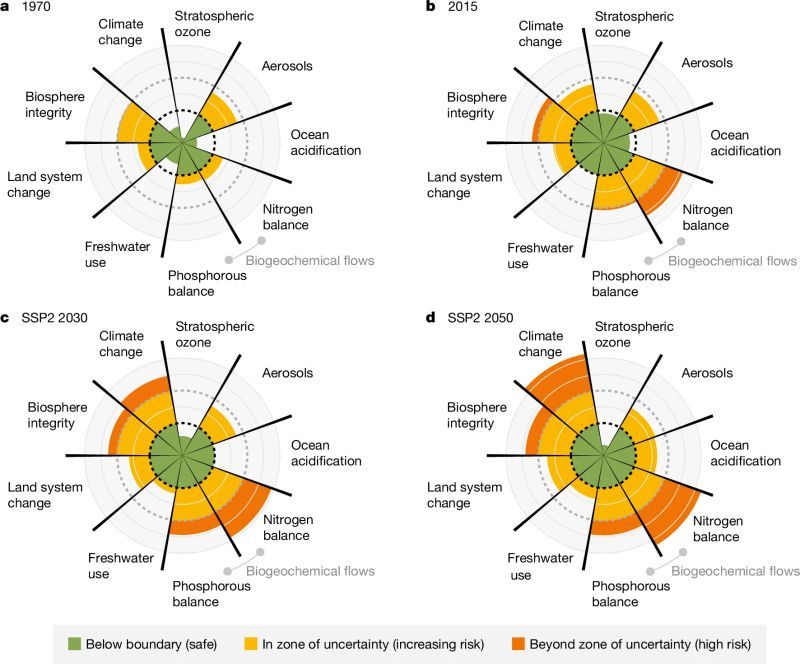

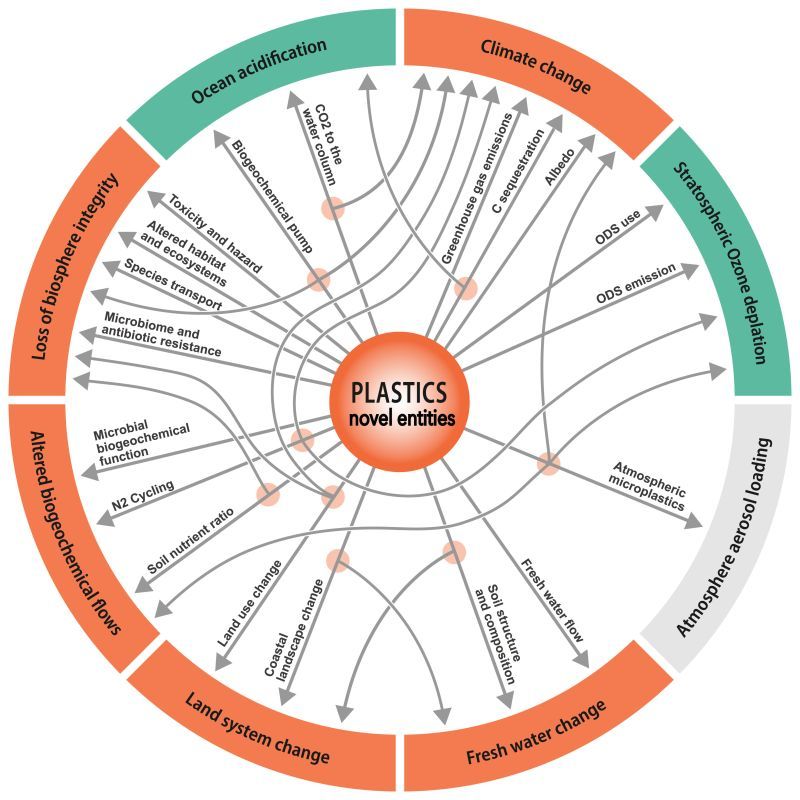

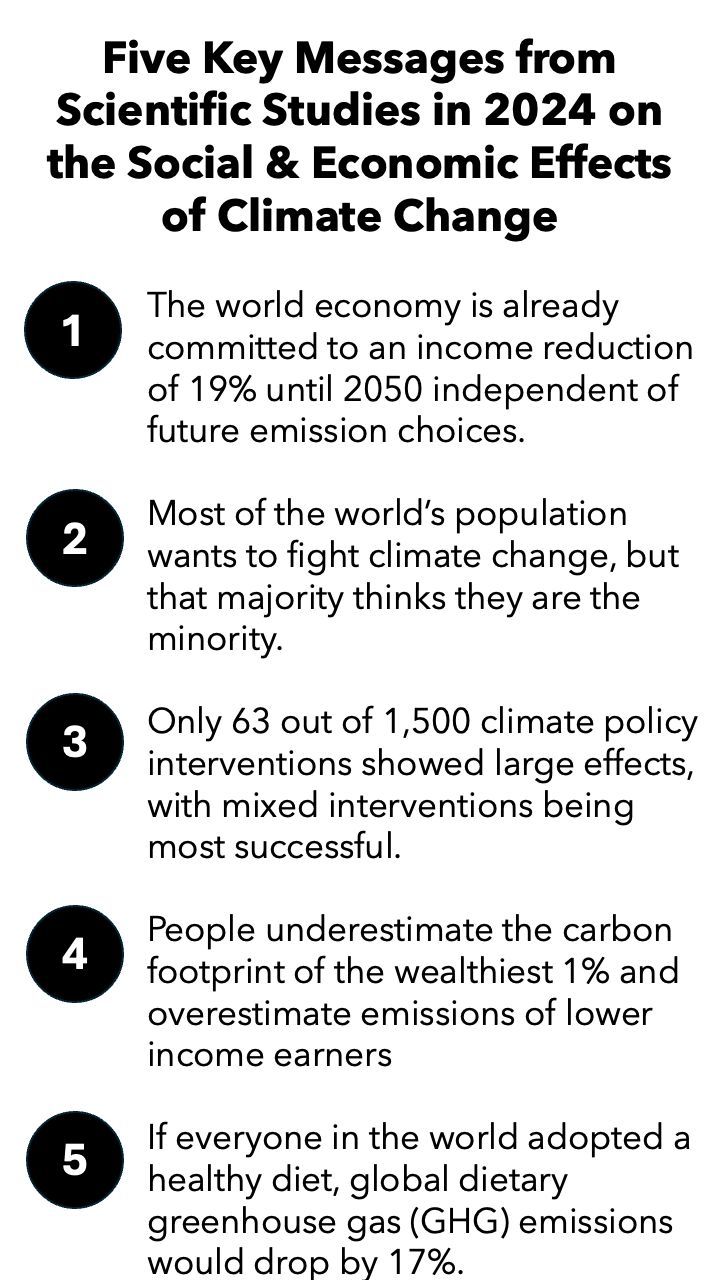

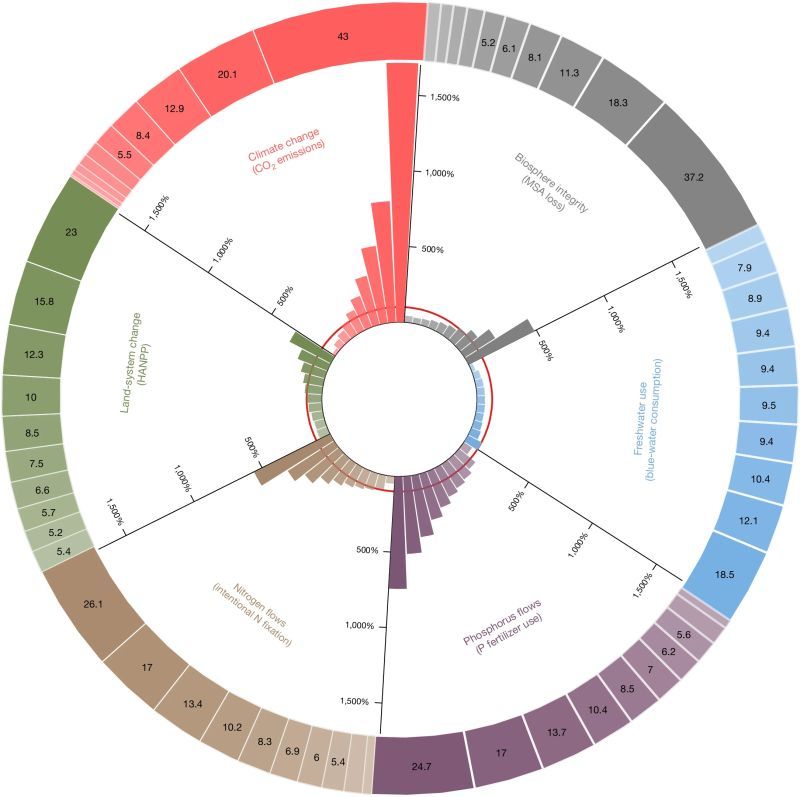

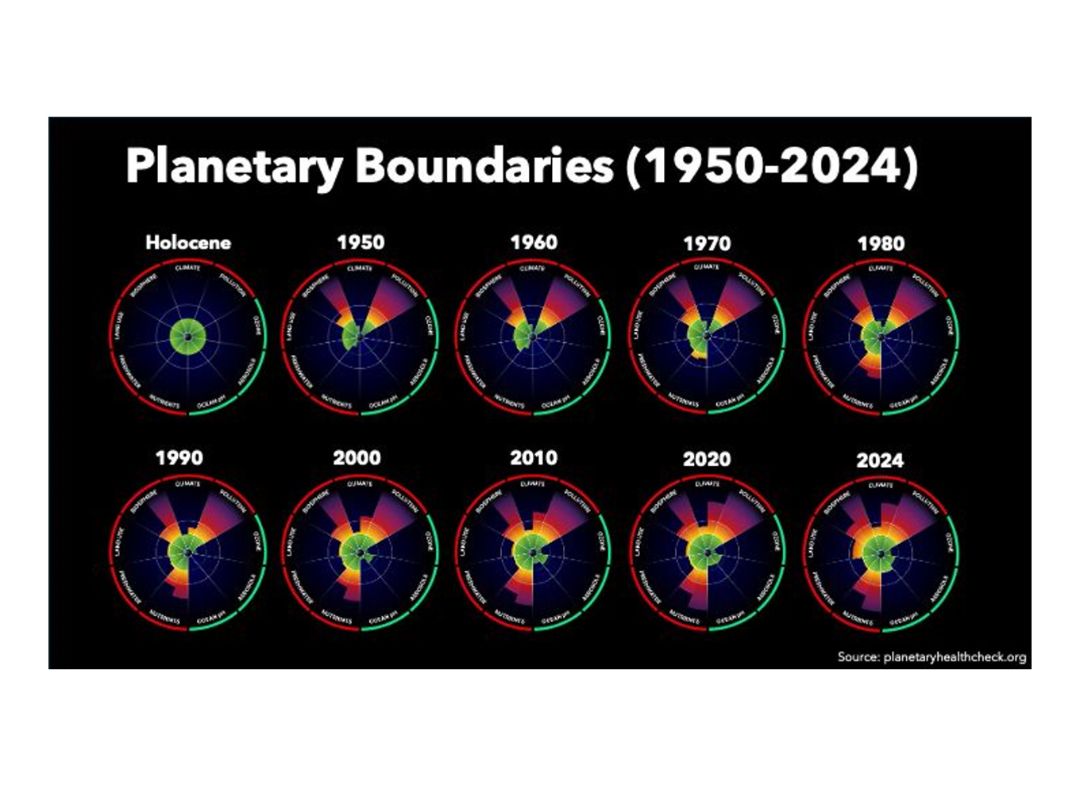

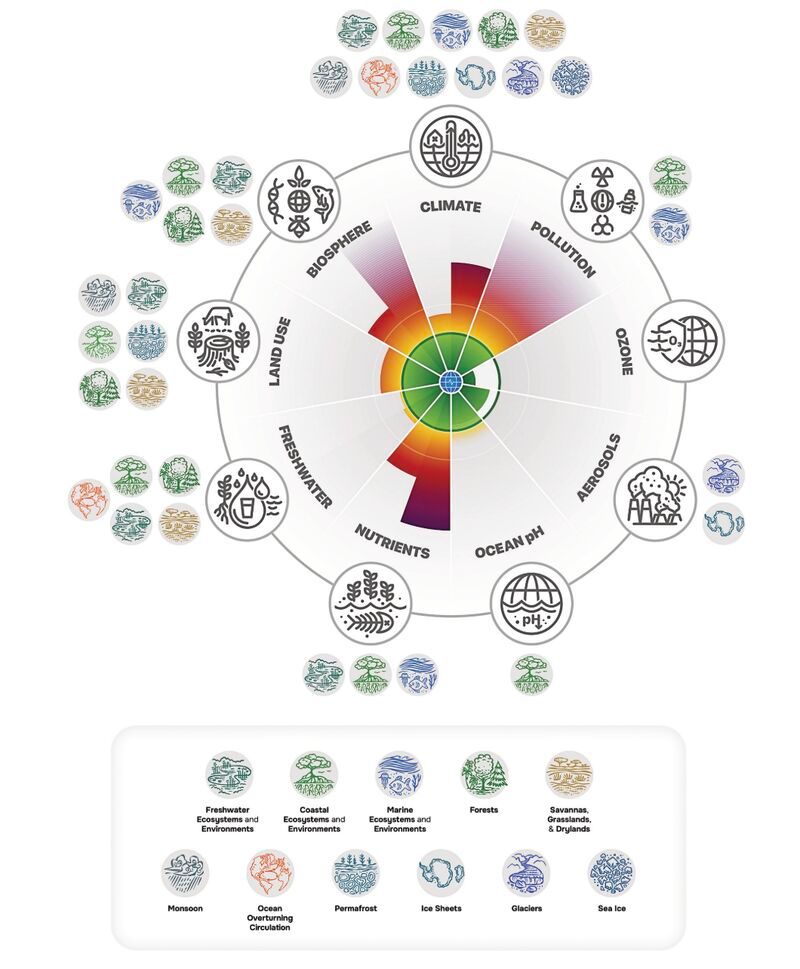

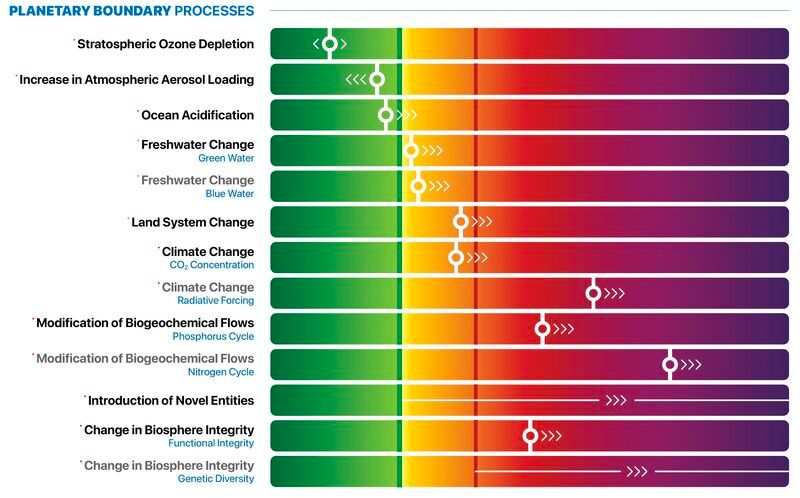

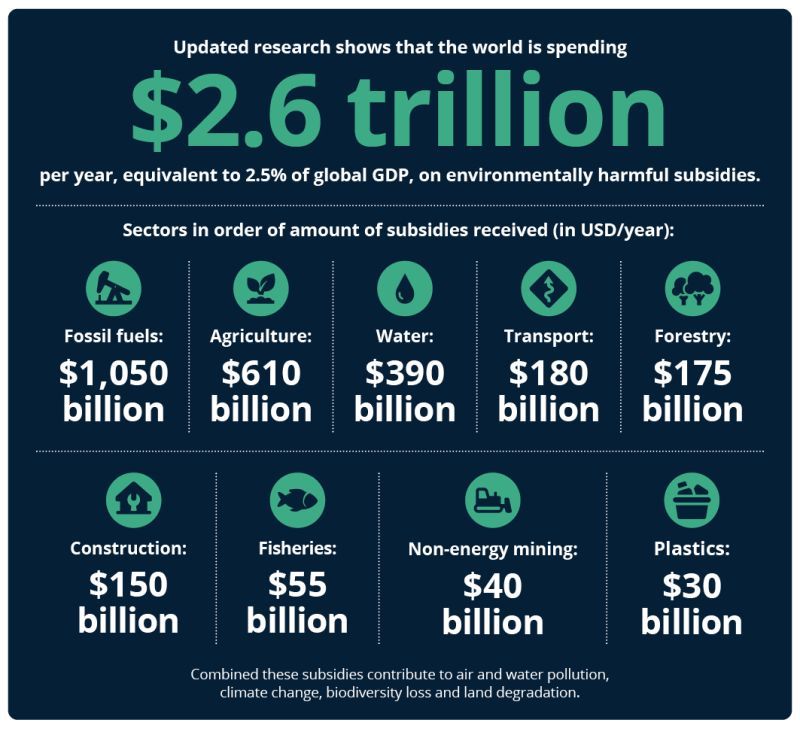

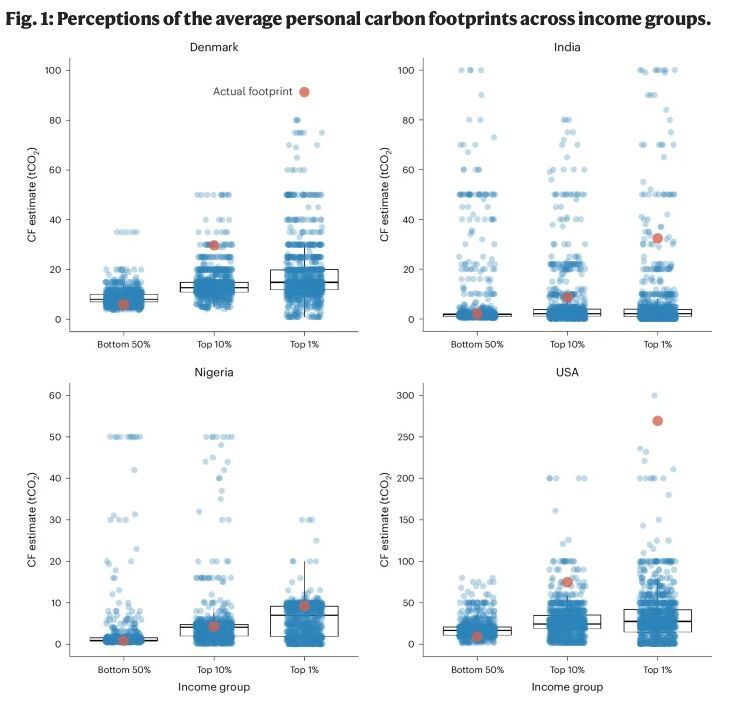

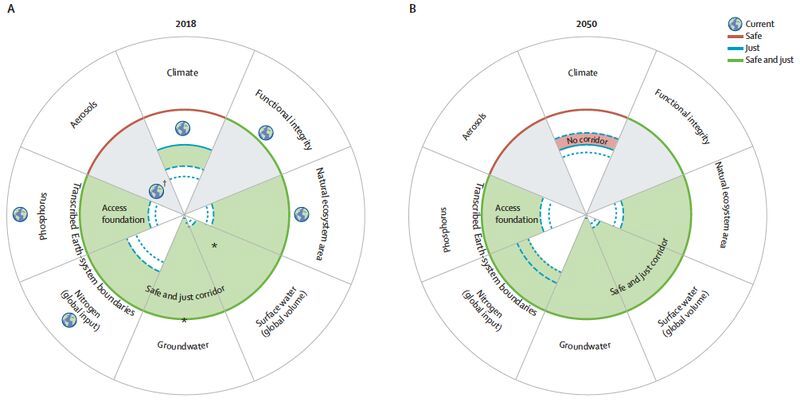

👉 Food systems are now the single largest cause of humanity’s overshoot of planetary boundaries, according to a report by the EAT-Lancet Commission. Food production contributes around 30% of global GHG emissions, 70% of freshwater use, and is a key driver of biodiversity loss.

Each year, around 15 million adults die prematurely due to unhealthy diets, exceeding the number of deaths caused by air pollution worldwide.

The message is clear: food systems are both a major part of the problem, but can also be a major part of the solution.

But policymakers do not push for structural shifts. The EU's 'Farm to Fork' strategy promised to enforce a Sustainable Food Systems Framework (SFSF). It was planned for 2023. As it stands, the SFSF is “missing”, without a justification or a revised schedule...

30-01-2026

As a result, importers reallocate volumes to alternative foreign suppliers - often at higher cost (e.g., logistics costs). This effect was identified for publicly listed firms that had ESG-sensitive investors.

Following an incident, these investors also exerted direct and indirect pressure: they reduced their holdings and sponsored supply-chain-related ESG shareholder proposals, accelerating firms’ disengagement from risky suppliers.

👉 Derisking global value chains is not free. Strong due diligence practices are therefore not just a compliance exercise, but a strategic investment - building risk awareness, reducing disruption, and limiting costly supplier switching.

A point worth reflecting on for companies exempt from the #CSDDD after the #Omnibus...

===

The study is published in The Review of Financial Studies (Oxford University Press).

29-01-2026

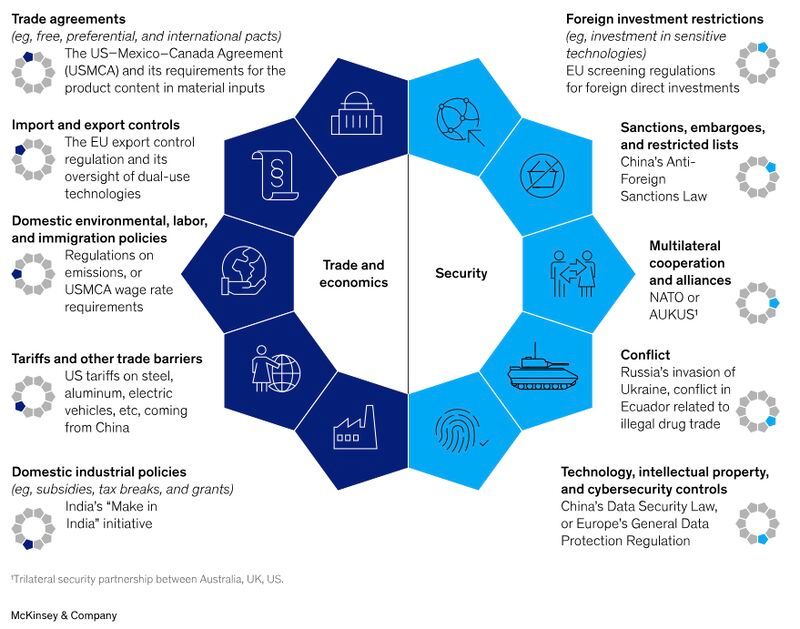

👉 Geopolitical considerations are mixed with industrial competitiveness, and green public procurement is used to boost demand and scale solutions. It seems to be the new "policy formula" upon which legislative proposals rest (see also the upcoming Industry Accelerator Act proposal).

Geopolitics comes in because the CEA could mandate the recovery of materials from waste streams (e.g., rare earths from e-waste) and thus reduce reliance on volatile foreign supply.

The CEA is expected to amend the Waste Framework and Landfill Directives as well as the Waste Electrical and Electronic Equipment Directive (+ additional measures such as harmonisation of environmental taxes).

This Briefing gives a good overview of where things stand right now. The CEA is expected for Q3/2026

28-01-2026

The 'Due Diligence Checkers' are for free and exist for (1) cross-sectoral use (generic), (2) minerals, (3) garment and footwear, and (4) agriculture. The evaluation works via a questionnaire and results can be downloaded as a customised PDF report.

👉 This is capacity building. No, it doesn’t capture the full complexity of due diligence systems - but it does offer a concrete, accessible starting point to test alignment with internationally recognised standards

The legal scope of the #CSDDD has been significantly narrowed, so building capacity for alignment with internationally recognised standards matters more than ever...

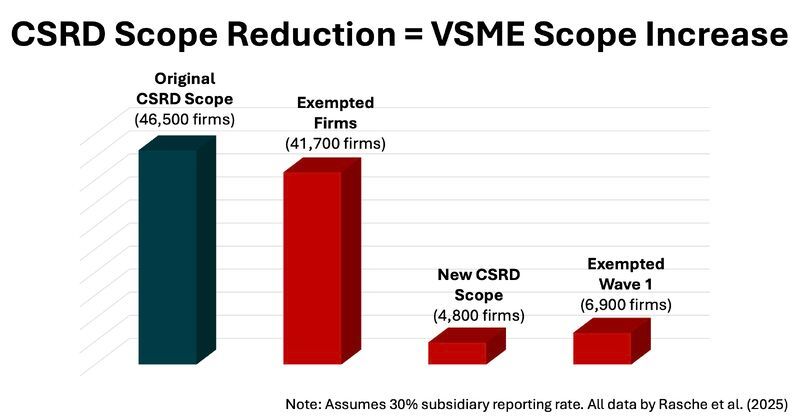

27-01-2026

A significant revision of the VSME ahead of its adoption in mid-2026 is unlikely. This will create challenges for mid-sized companies, especially those 6,900 firms that had already reported under the NFRD and CSRD Wave 1.

Some of the friction may be alleviated by the launch of the dedicated portal foreseen under revised Article 29e - this portal will include new templates and guidance (likely to better serve larger firms).

Then, we have: (1) firms applying VSME, (2) firms applying VSME + templates, (3) firms applying other standards (e.g., revised ESRS, ISSB). This looks less like simplification - and more like fragmentation.

👉 The fundamental problem remains: exempted firms are being encouraged to use a voluntary standard that (a) was not designed for their size or complexity, and (b) is, in some respects, difficult to justify as proportionate.

===

Thanks to Simon Taylor, with whom I’ve been debating this topic for some time.

26-01-2026

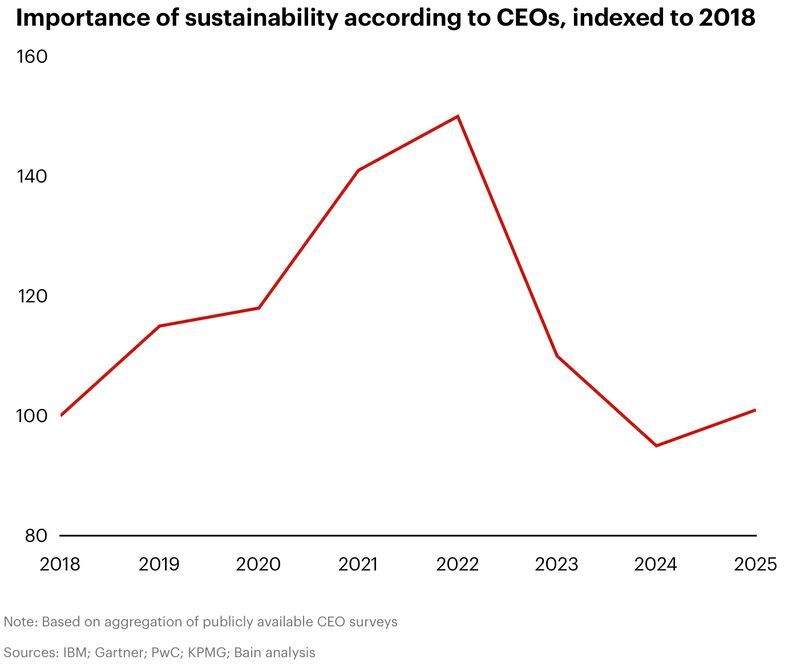

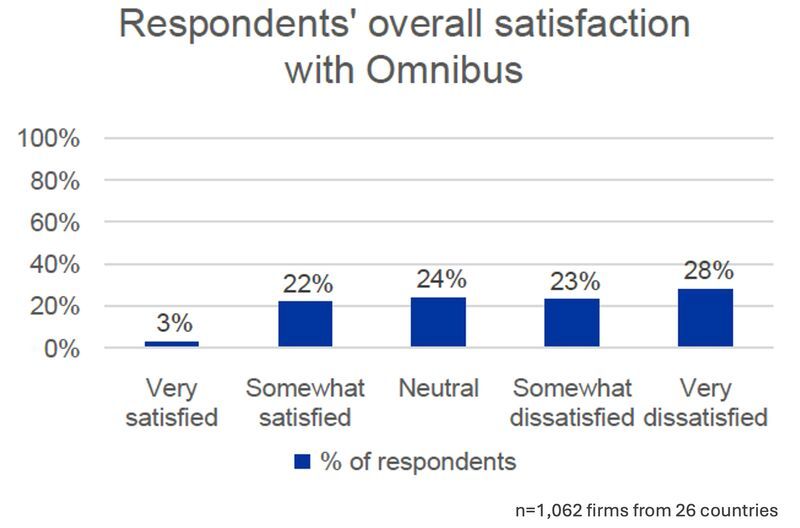

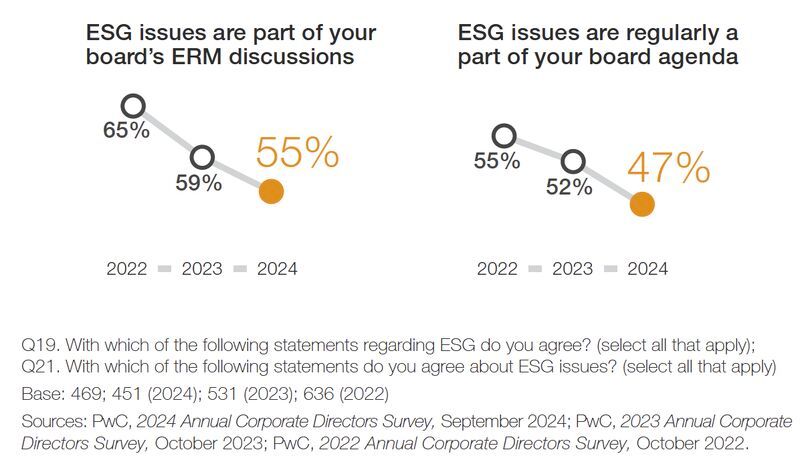

This muted effect is not driven by a lack of interest in sustainability. Rather, it reflects a more fundamental issue: SFDR failed to deliver information that investors perceive as 'new' and 'understandable'.

Information must be new and understandable to make a difference, and it has to reach its audience (awareness). Yet, through a survey the study shows that SFDR information was not well understood, and only 23% of end-investors had a basic awareness of the regulation (n=1,465).

SFDR 2.0 needs a genuine 'consumer strategy'. An EU-wide survey studying whether the new category names and the intention behind them are understood by end investors is therefore critical - as rightly acknowledged by the new proposal...

22-01-2026

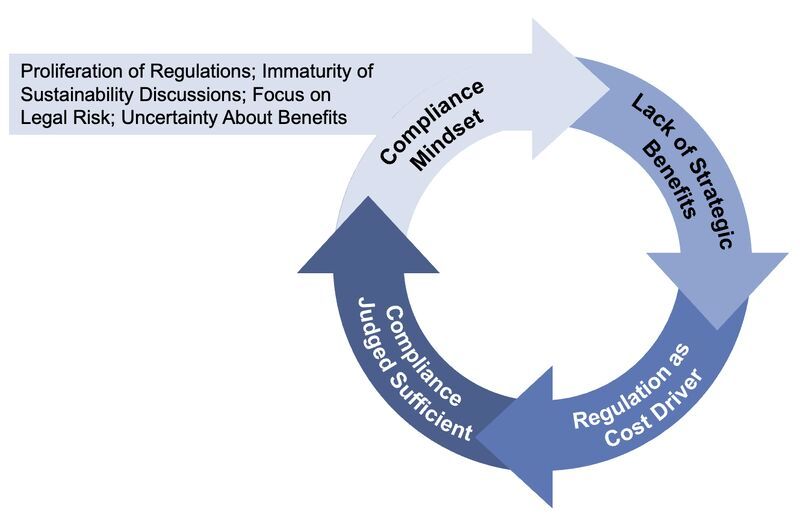

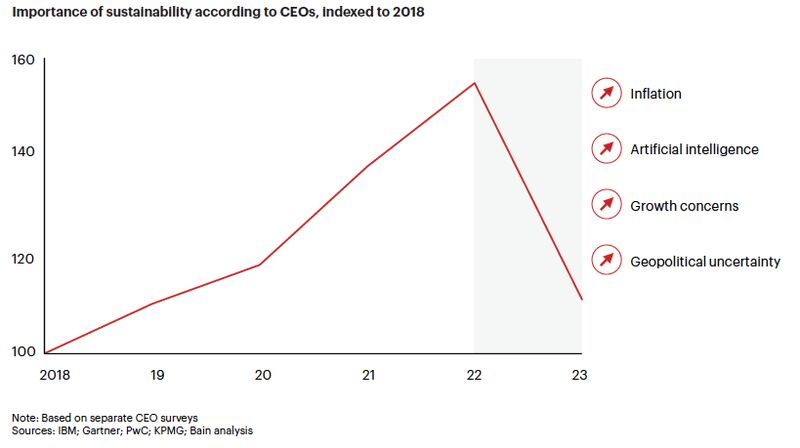

This “compliance view” makes the Green Deal vulnerable to debates like regulatory simplification, as costs start to dominate the discussion.

👉 It is time to not just see the Green Deal as a bunch of regulations. Its core objective – climate neutrality by 2050 – is fundamentally about Europe’s independence and strategic autonomy.

In 2024, Europe’s energy import dependency stood at 58%. Decarbonisation is about reducing this dependency – without simply replacing it with new ones.

When speaking with companies, I often hear that sustainability is being sidelined by geopolitics these days. That framing misses the point. We need to stop drawing artificial lines between sustainability and geopolitics…

===

Image Credit: Circulaw. Note: The image lists CSDDD under the "Reporting" pillar. I think it is misplaced there, as it is about substantive behaviour.

20-01-2026

▶️ The IAA is supposed to accelerate industrial production by building "lead markets" for low-carbon industrial products (e.g., cement, steel, aluminium). The idea is to leverage the Single Market to boost demand for such products.

▶️ The Act imposes emission and origin criteria to be met in certain public procurement processes, first targeting energy-intensive products with a focus on construction. Procurement can prioritise "Made in EU" where this supports the blocs strategic autonomy and decarbonised industrial capacity.

▶️ It frames a harmonised low-carbon label and verification mechanism as a way to shift competition toward performance rather than cost. The label is not a new certification system, but relies on existing frameworks (e.g. Ecodesign for Sustainable Products Regulation).

There is also a geopolitical dimension to this - the Act allows to specify third countries to be included in the "Union Origin" definition.

While things are still moving (especially on green steel), it shows the direction of travel. The IAA is scheduled for public release on 29 January.

👉 Despite the heavy simplification pushback related to #Omnibus I, the EU is still pushing elements of the sustainability agenda with a renewed framing...

20-01-2026

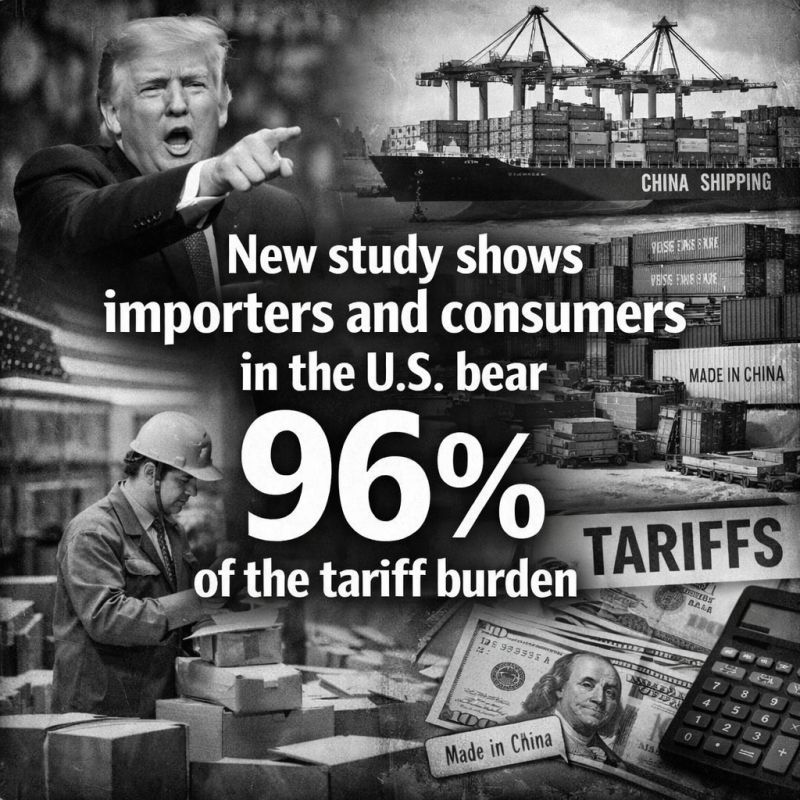

In other words: "[F]or every $100 in tariff revenue collected, roughly $96 comes out of American pockets and only $4 represents a reduction in foreign exporter profits." In 2025, American businesses and households therefore paid nearly $200 bn in a sort of tax.

The study shows that trade volumes adjust, not prices. Of course, the reduction in volume also hits exporters. But Trump's claim that tariffs transfer wealth from foreign nations to the U.S. is not correct. The transfer happens from U.S. consumers and importers to the U.S. Treasury...

===

The study was conducted by the Kiel Institute for the World Economy in Germany.

19-01-2026

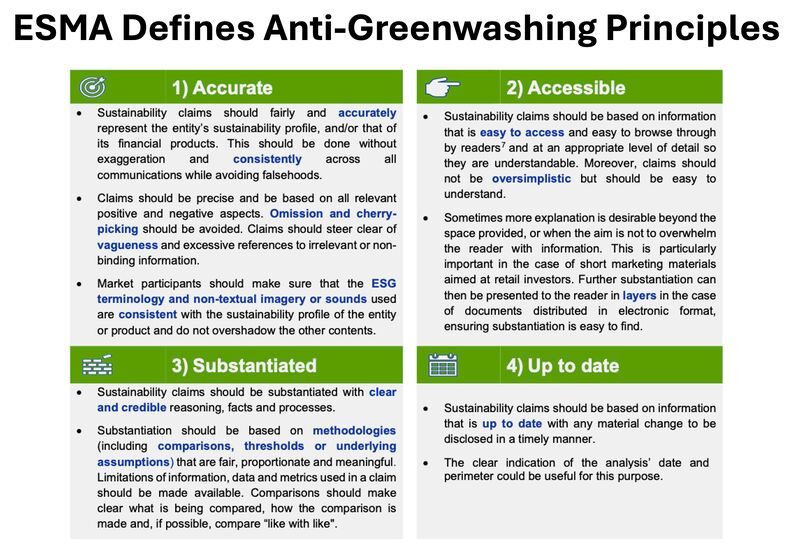

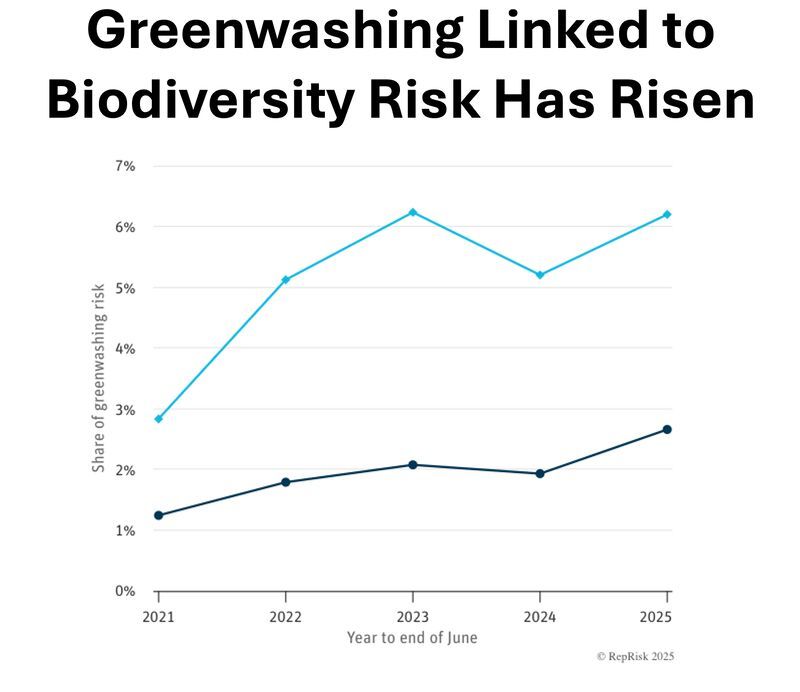

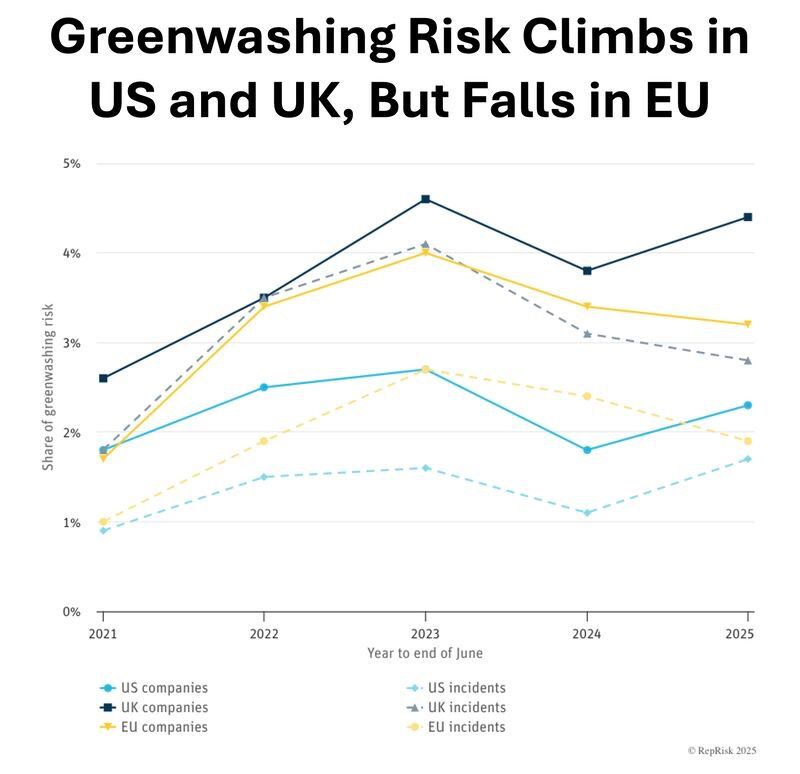

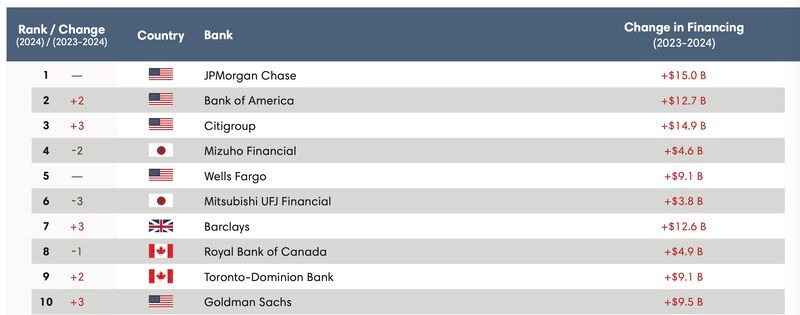

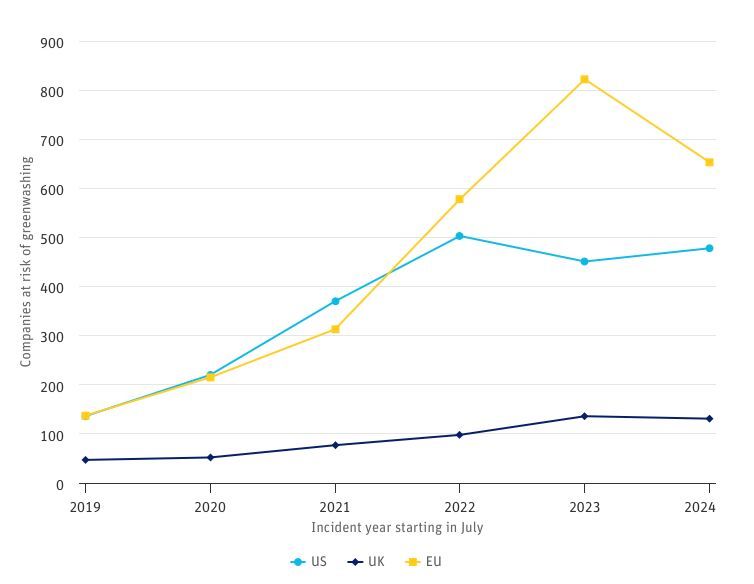

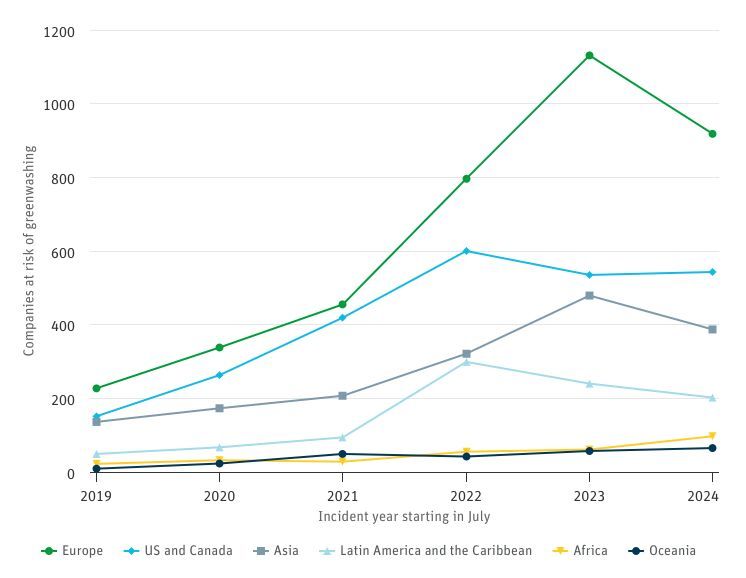

This is a timely move. Recent RepRisk data identifies Banking and Financial Services as the sector with the highest greenwashing risk - by a wide margin.

While ESMA’s principles do not introduce new disclosure requirements and do not constitute new regulation, they are far from symbolic. They sharpen supervisory expectations and translate them into a number of "do’s and don’ts" for sustainability-related communications.

ESMA points to significant inconsistencies in how firms communicate around ESG integration and exclusions. Such "divergent market practices" create "a risk of claims being misinterpreted and investors being misled."

The message is clear: European supervisors are paying much closer attention when it comes to greenwashing-related risks...

16-01-2026

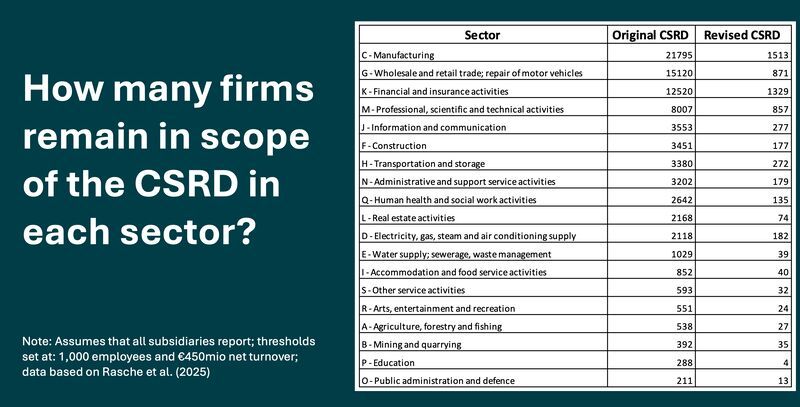

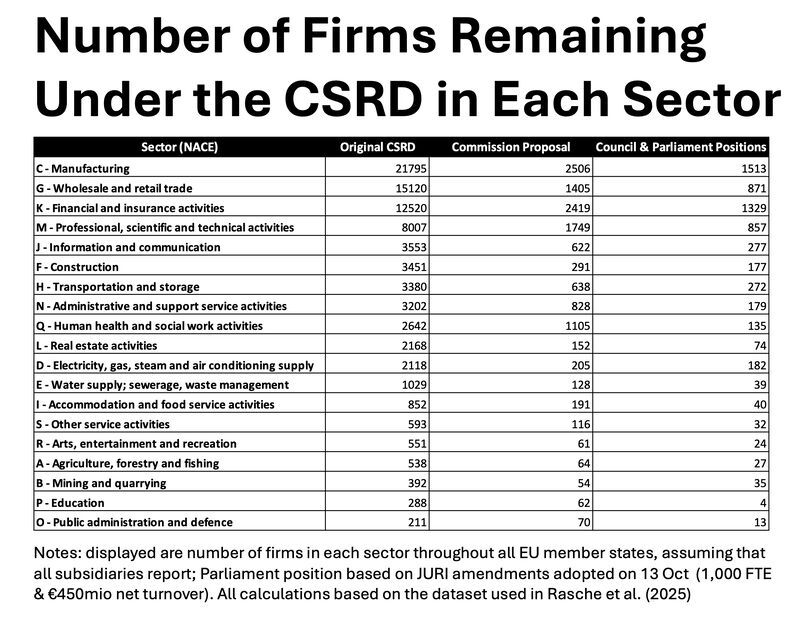

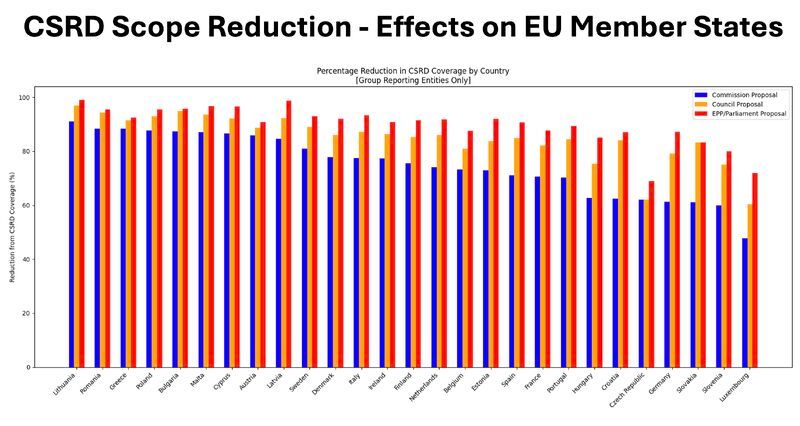

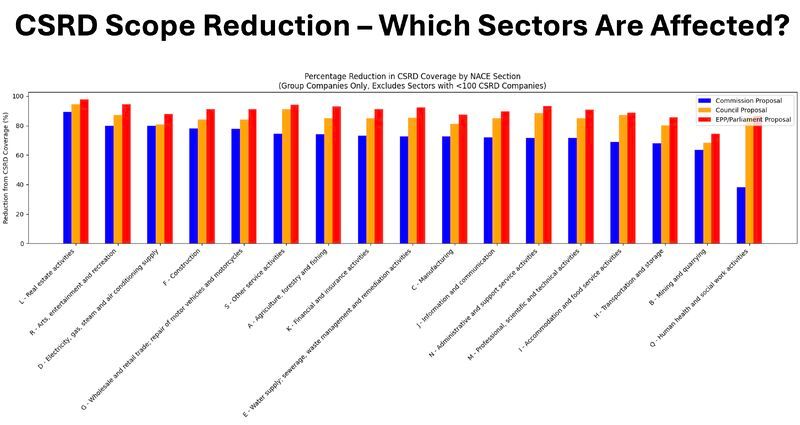

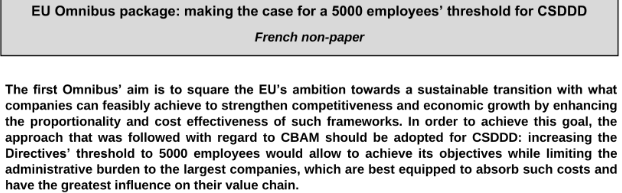

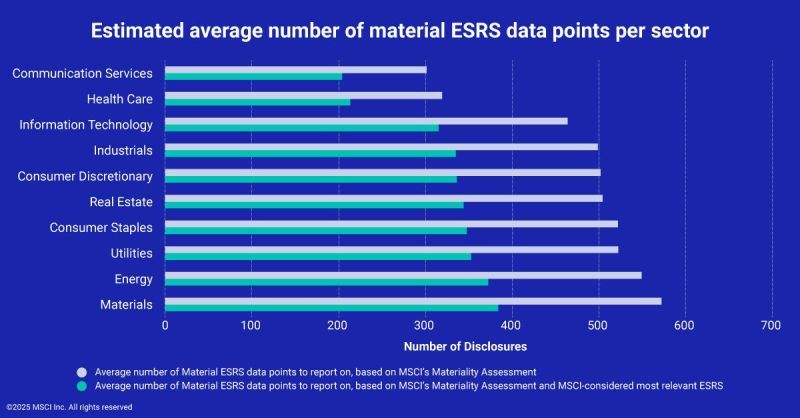

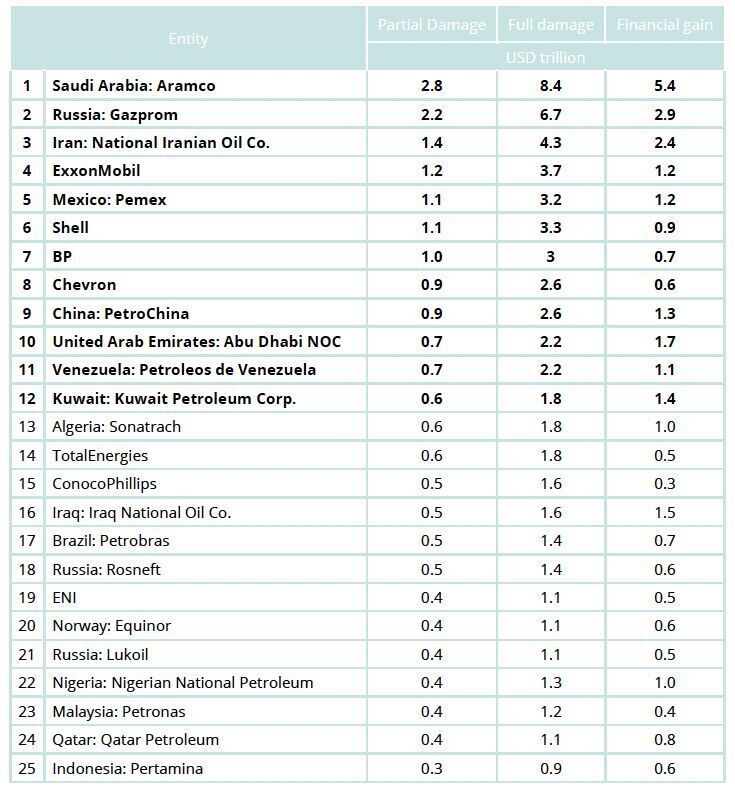

This is where the #Omnibus I missed a critical opportunity. Rather than differentiating more intelligently between sectors, simplification was applied with a 'broad brush'. High-impact sectors could have been exposed to different threshold to ensure a better sustainability information architecture.

This outcome was not inevitable. The tools already exist. The EU’s own Economic Activity Classification (Regulation (EC) No 1893/2006), also used in the Paris-aligned Benchmarks framework, could have supported sector-specific thresholds and a far more targeted approach.

👉 Simplifying with precision remains a challenge for the EU - and it is something to consider for pending (and future) EU Omnibus packages...

15-01-2026

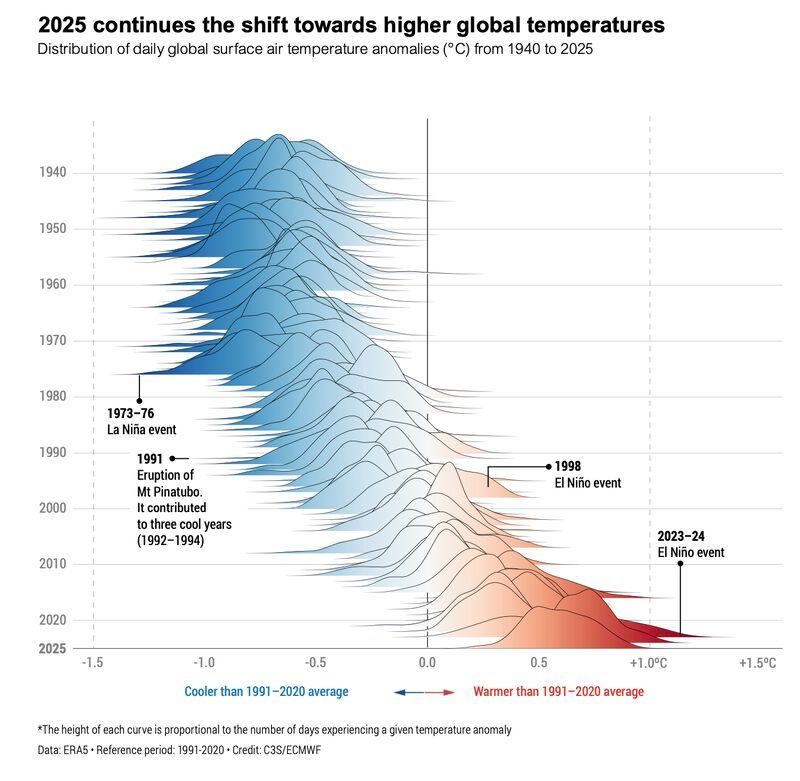

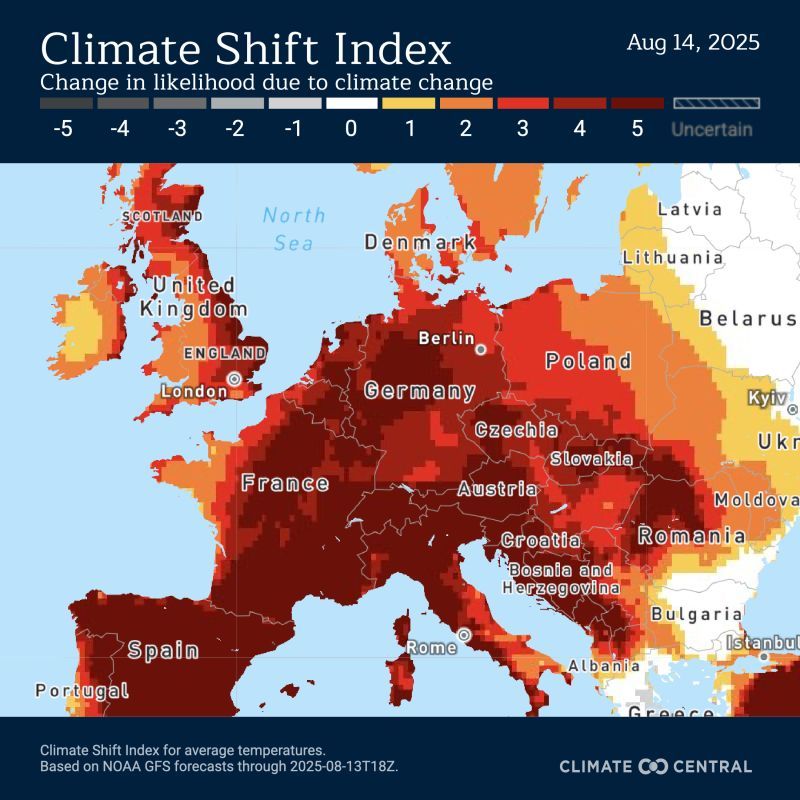

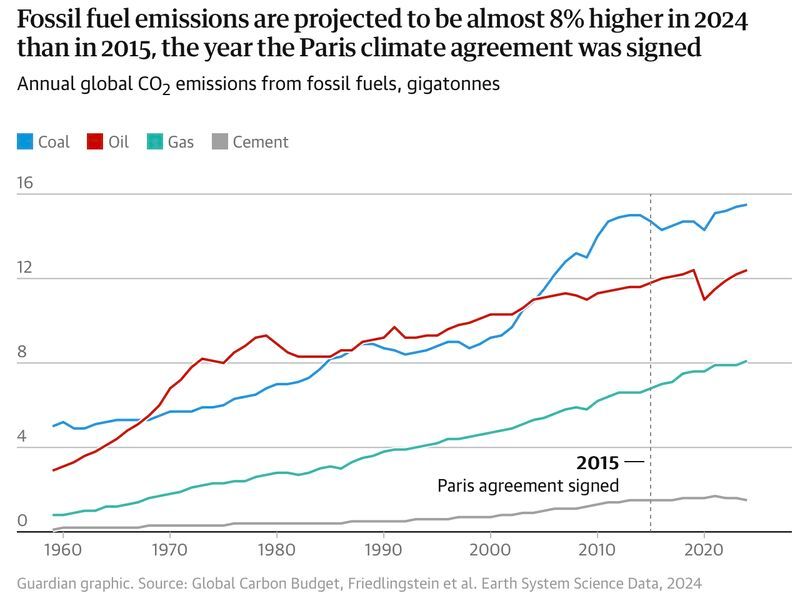

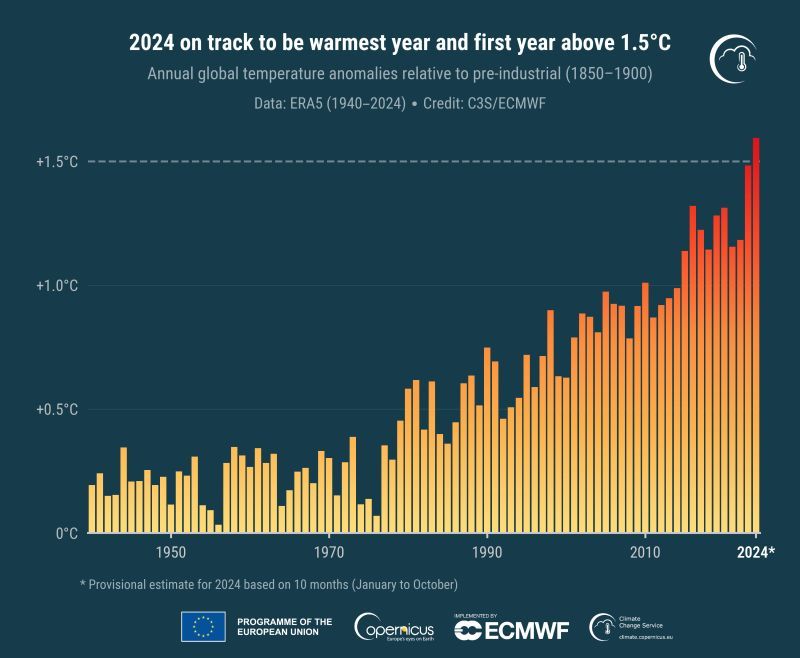

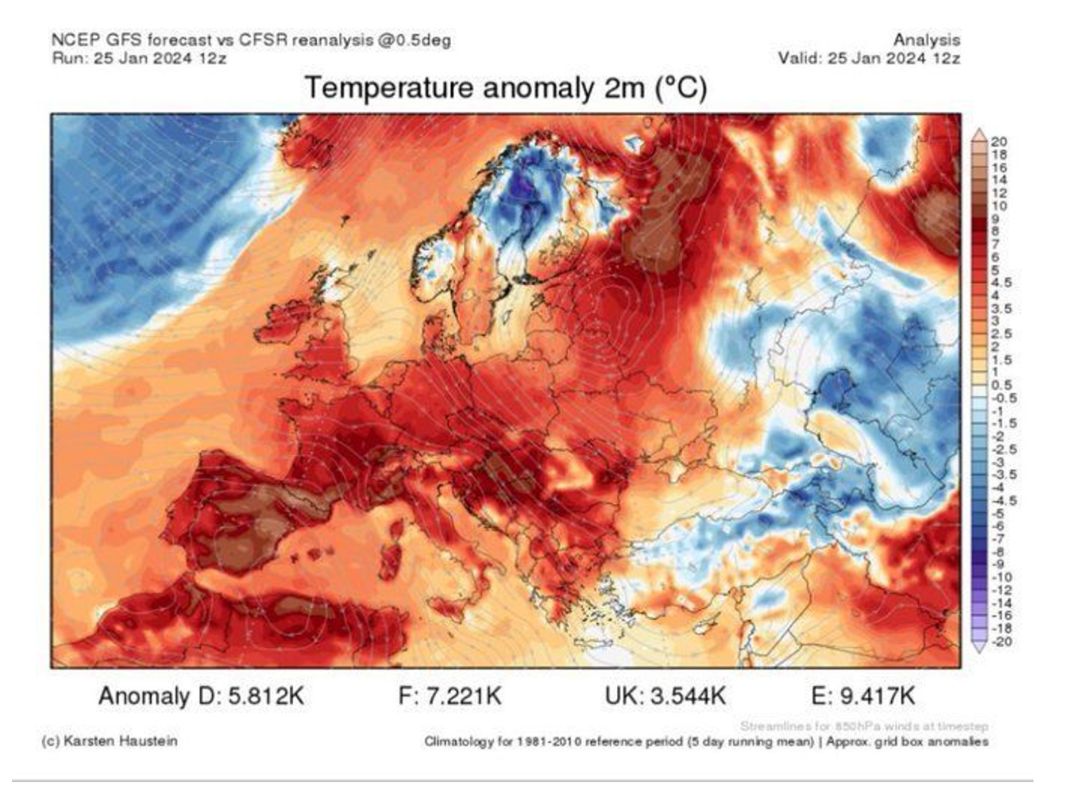

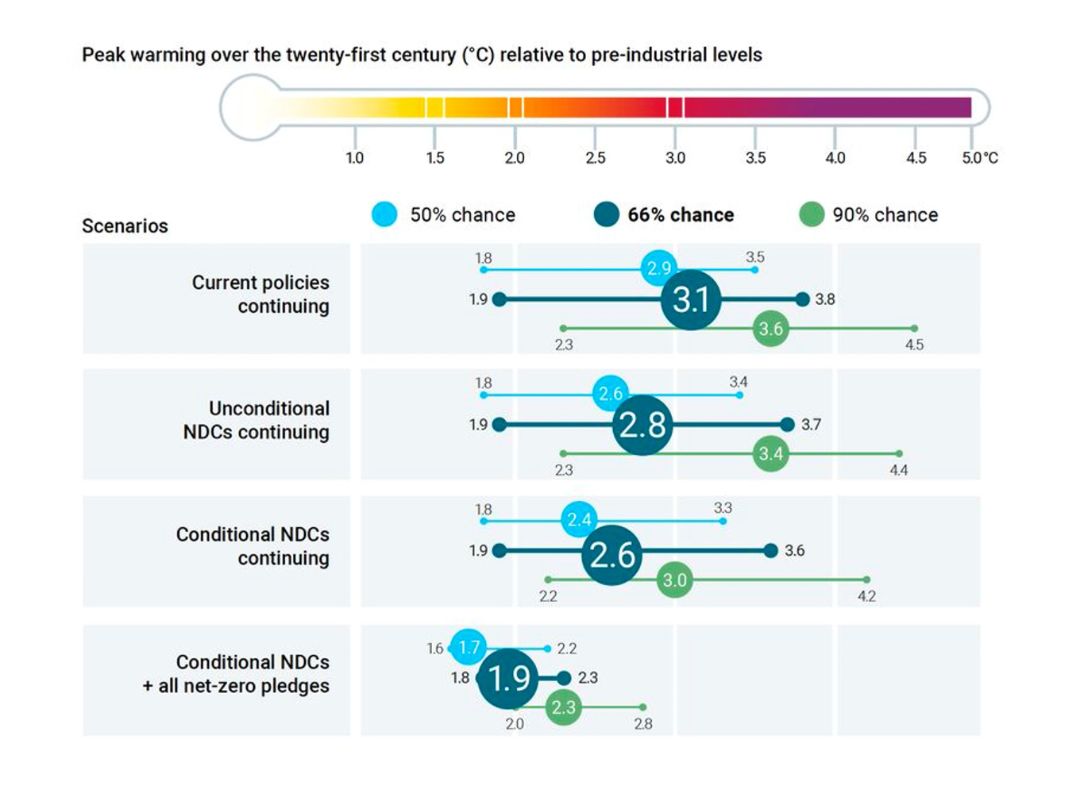

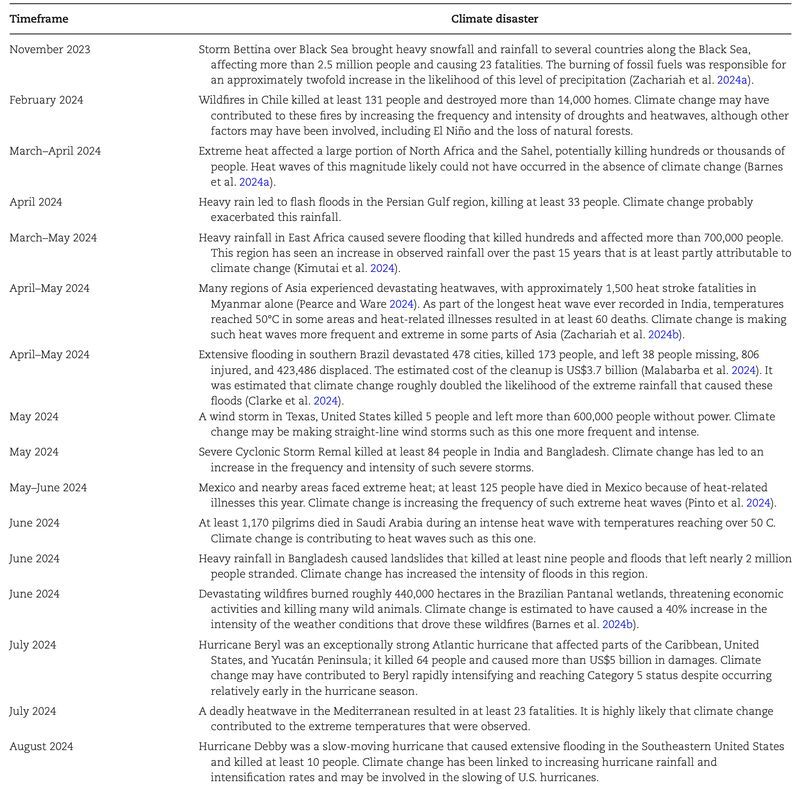

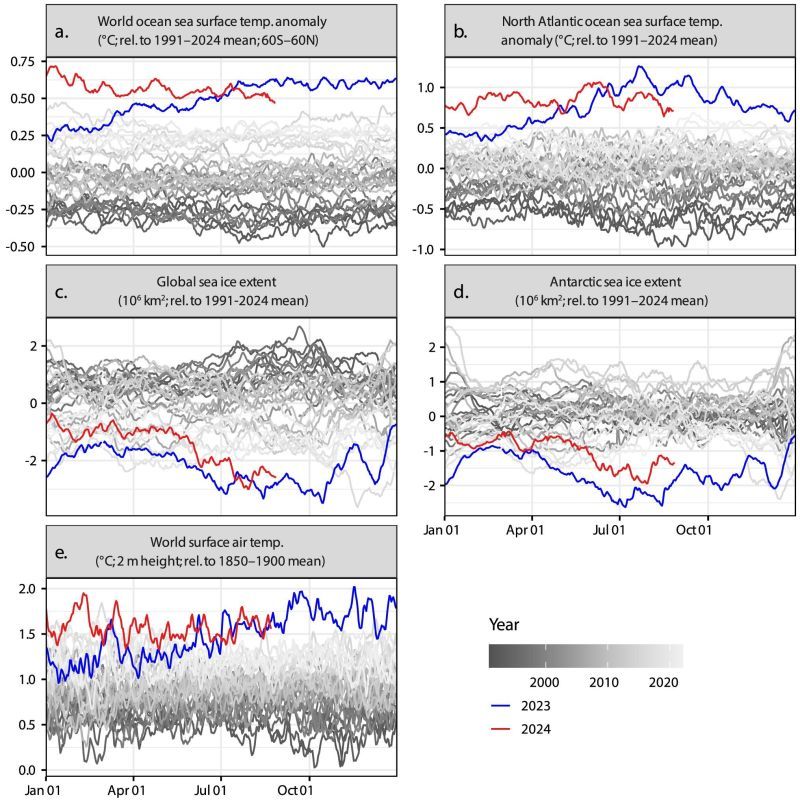

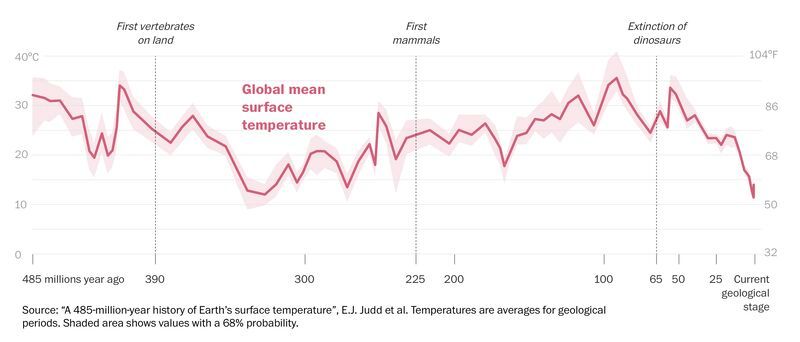

The new data shows that the globe has warmed 1.4°C (above pre-industrial). We will bulldoze through the Paris Agreement goal by May 2029, if warming continues at the same rate.

And yet EU policymakers believe it is a good idea to exempt 90% of companies from reporting on their Scope 1, 2 and 3 emissions under the #CSRD. This is difficult to reconcile with the scale and urgency of the challenge.

Data collection does not reduce emissions on its own. But without it, companies are flying blind when it comes to understanding and reducing their carbon footprint.

15-01-2026

Importantly, such legislation needs to reach beyond just a few very big companies because it is supposed to level the playing field and provide scalable solutions. Reducing the scope of the #CSDDD by 70% is a move in exactly the opposite direction.

The study by the World Benchmarking Alliance also finds that the 20 best performing companies on the 2026 Social Benchmark are all headquartered in Europe. An encouraging insight and certainly something worth defending.

👉 The problem is not regulatory simplification, but simplifying the simplification debate...

12-01-2026

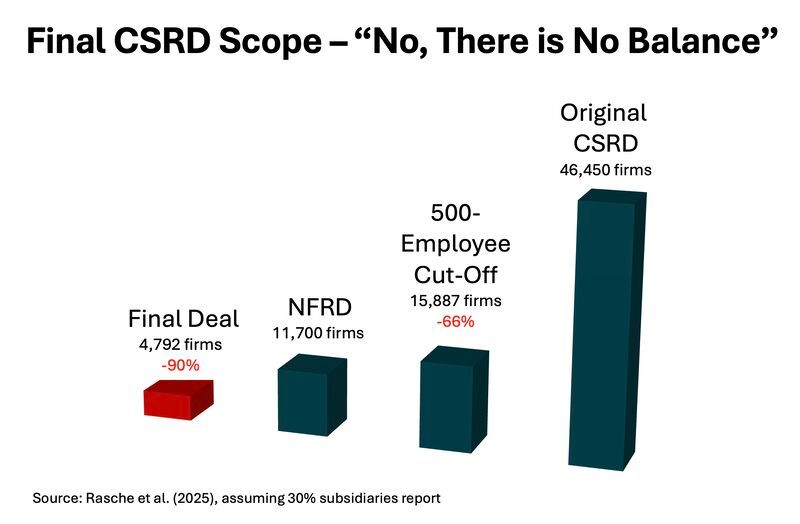

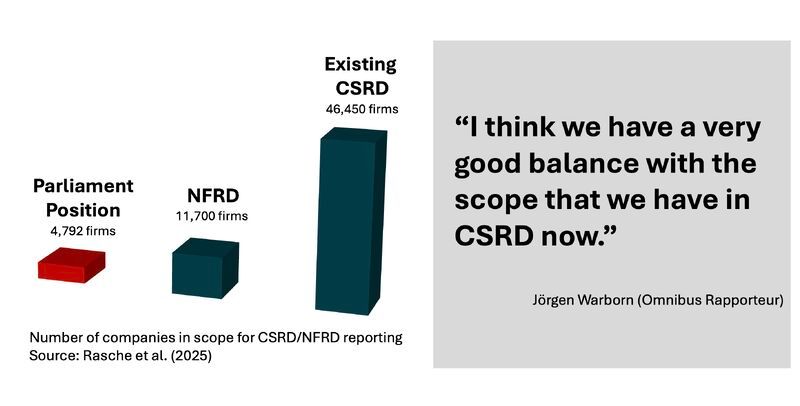

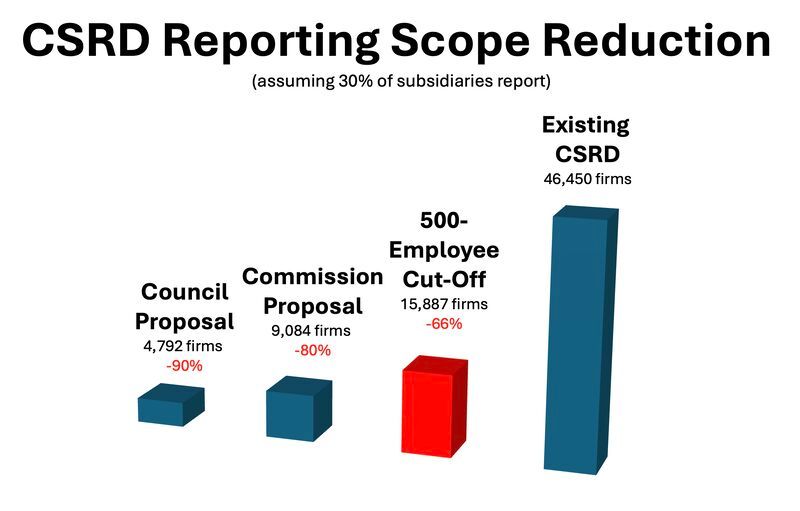

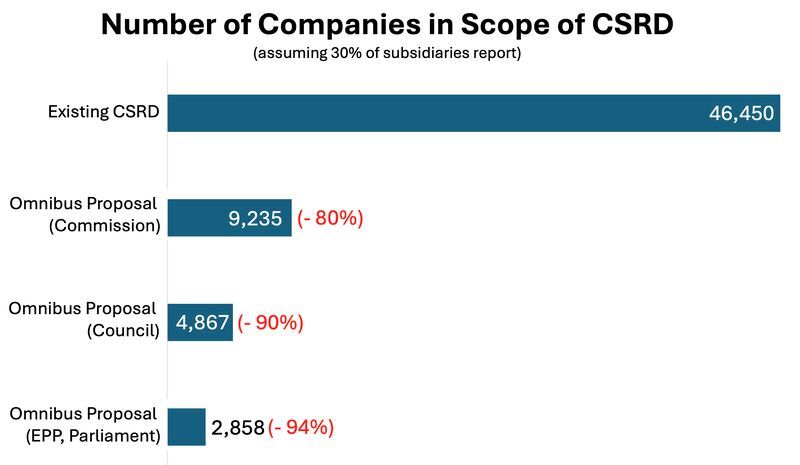

This level of scope reduction undermines proportionality. The Draghi report, which is often cited in support of these changes, did not argue for deregulation. It called for regulatory standards to be better calibrated to company size. That objective has not been met here, in my opinion.

For Member States, reduced transparency will make it harder to distinguish leaders from laggards. This can undermine evidence-based policymaking, e.g. when deploying policy instruments such as subsidies in a targeted manner.

👉 The #Omnibus exempts around 42,000 European firms from the CSRD. While policymakers have many tools at hand to ensure proportionality (e.g. defining tiers with differentiated requirements), what was delivered is a broad-brush approach that simply swept companies out of scope…

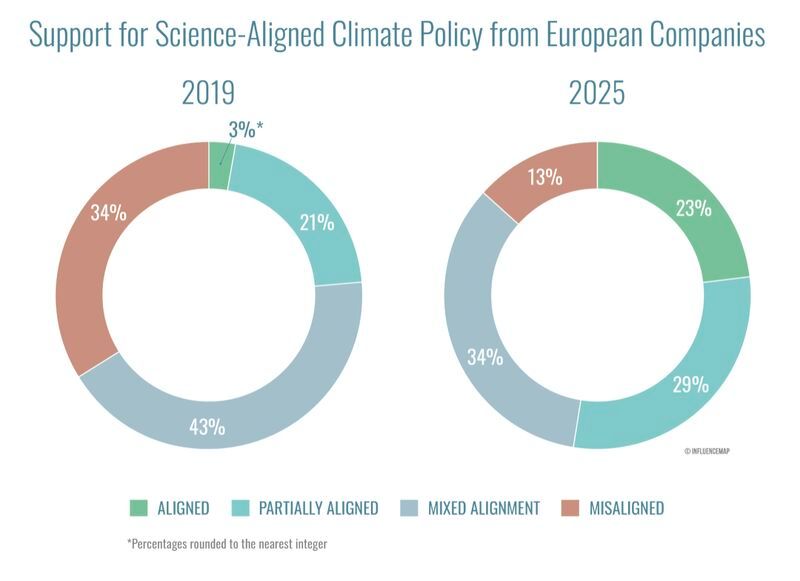

09-01-2026

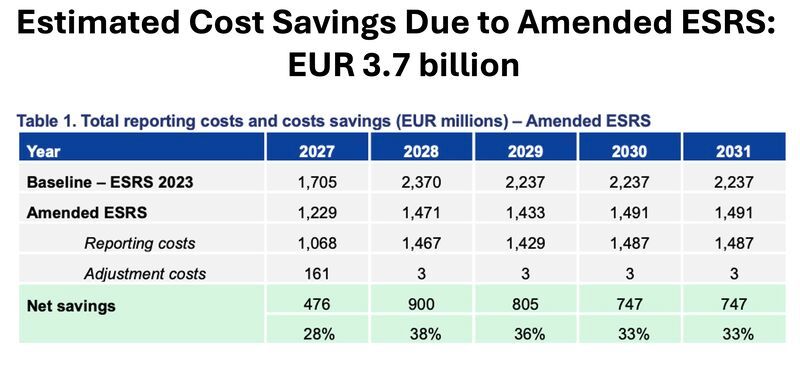

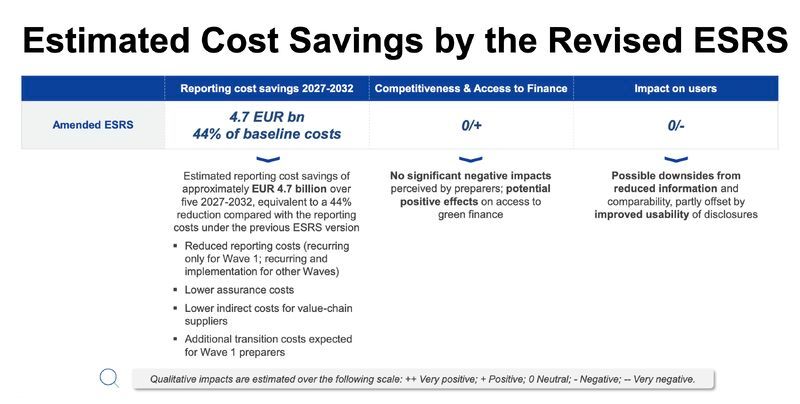

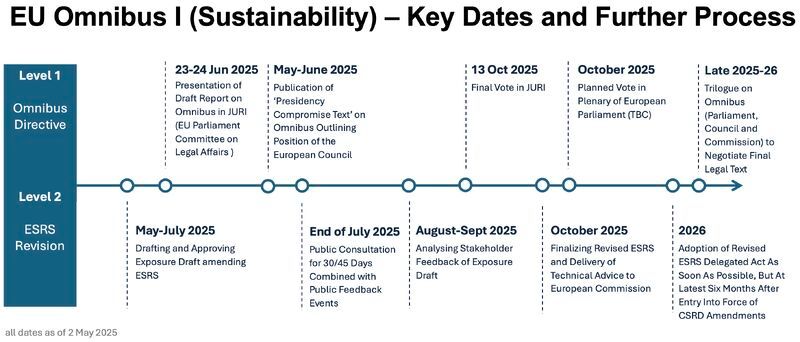

1️⃣ If such substantial cost savings can be achieved by amending implementing acts (i.e.: the ESRS - level 2), it raises an obvious question: why was it deemed necessary to immediately reopen the #CSRD directive itself (level 1) and exempt around 90% of companies?

There is a clear lesson here for future #Omnibus packages: start simplification by adjusting delegated/implementing acts, collect evidence, and only reopen directives if unavoidable. This also improves regulatory predictability...

2️⃣ The study also finds that firms do not expect significant positive or negative effects of the amended ESRS on their competitiveness. This calls into question how much the Omnibus can realistically deliver on its core promise of “boosting competitiveness”.

08-01-2026

The stated justification: “Many of these bodies promote radical climate policies, global governance, and ideological programs that conflict with U.S. sovereignty and economic strength.”

In total, the U.S. will leave 31 UN entities (incl. UN Water and the UN Population Fund) and 35 non-UN organisations (such as the International Energy Forum).

👉 This is deeply embarrassing, short-sighted, and marks a new low - even by Trump Administration standards. The decision further isolates the U.S. - it will be the only country out of 198 not party to the UNFCCC. Alone. By choice.

And it is ultimately self-defeating. Climate action, energy transition, and global coordination will continue, without U.S. leadership, influence, or credibility at the table.

The rest of the world will move on...

06-01-2026

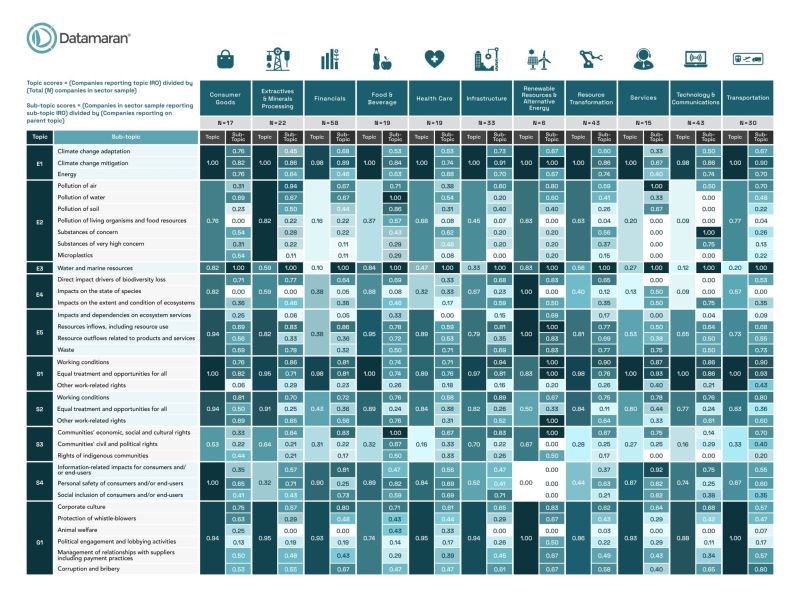

This overview by Datamaran shows how taxonomy frameworks are rapidly evolving globally.

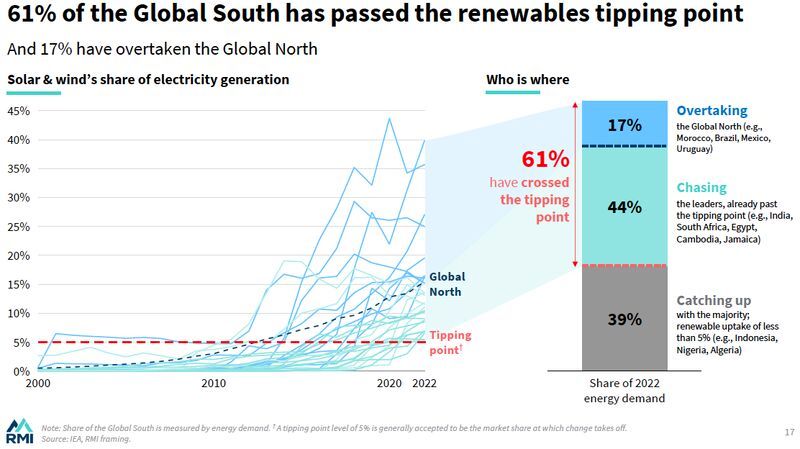

While only 11 taxonomies are currently mandatory, the direction of travel is clear: many non-EU countries are moving to close the gap in sustainability regulation.

We see a similar trend in sustainability reporting where major jurisdictions have released standards (e.g. China just very recently) and the ISSB's standards are gaining traction in many countries.

👉 In a global regulatory environment, it is vital to move early and keep pace. First movers shape standards, influence market practice, and create reference points that others build upon.

Otherwise, the sustainability rules for EU companies will be written elsewhere...

06-01-2026

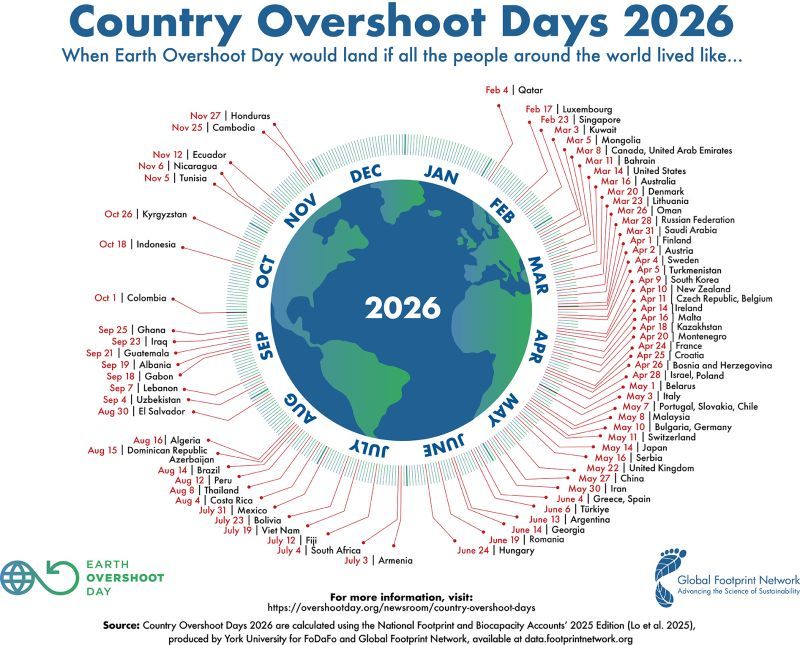

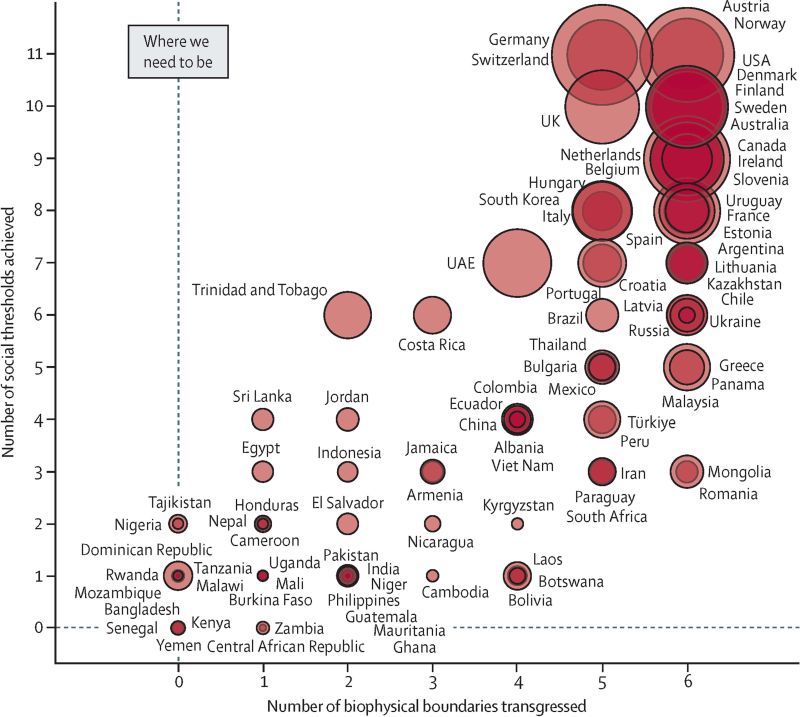

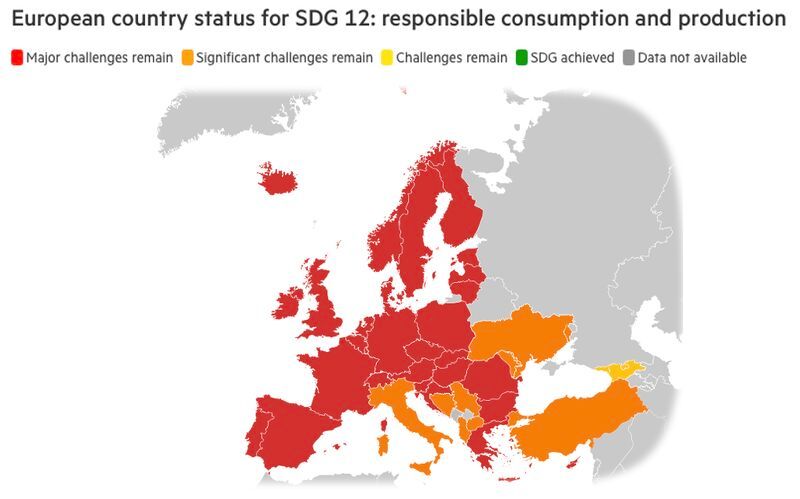

A country's overshoot day marks the date when Earth’s annual biocapacity would be exhausted if everyone lived like the average resident of that country.

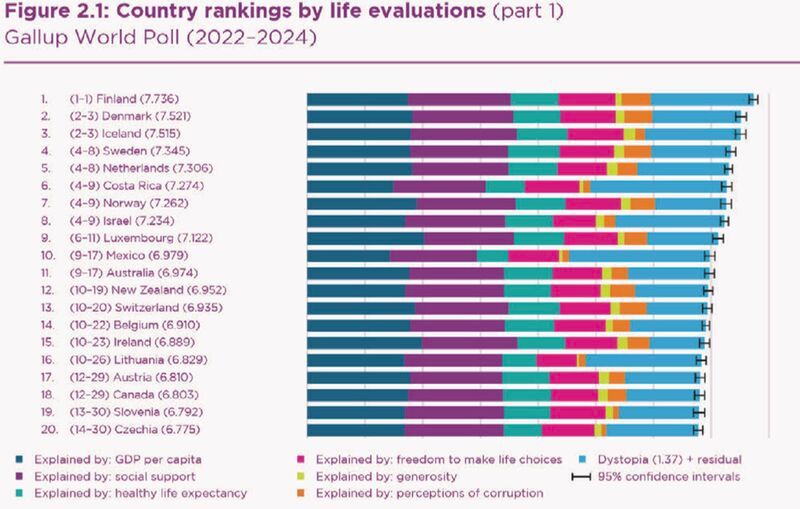

Denmark has one of the earliest overshoot days (20 March 2026) - despite ranking 3rd globally on SDG progress. This is not a contradiction; it is a measurement problem.

Overshoot calculations shift the conversation towards the resources consumed per person and hence highlight inequalities in resource use much better.

The uncomfortable takeaway is this: global overshoot is not an abstract failure. It is the cumulative result of lifestyles that are not globally replicable...

29-12-2025

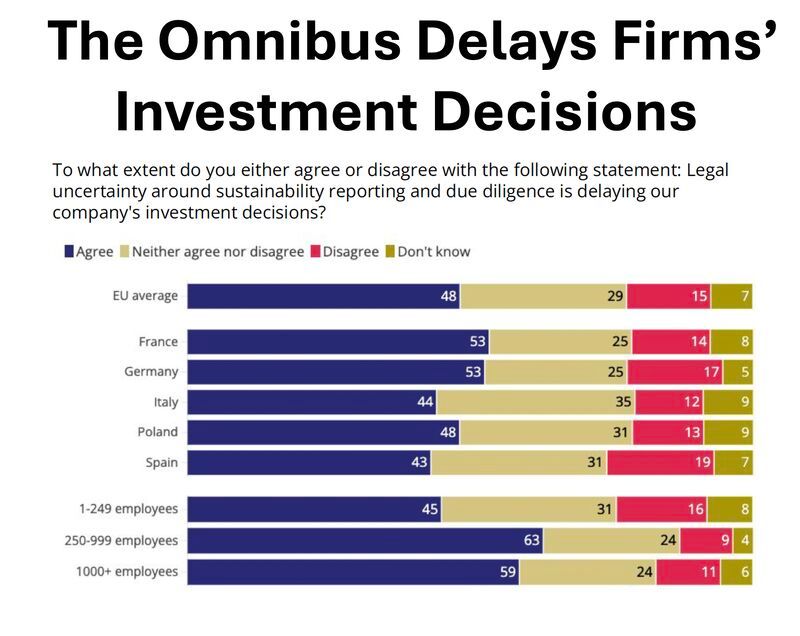

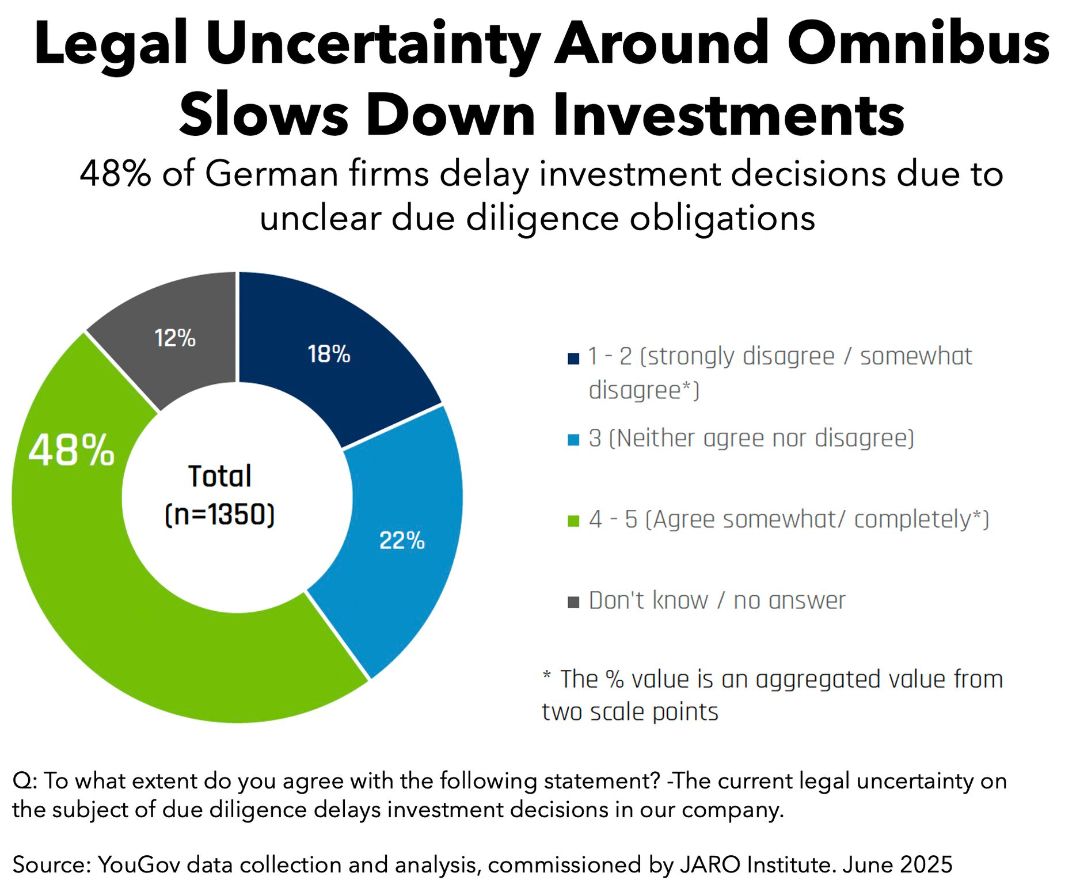

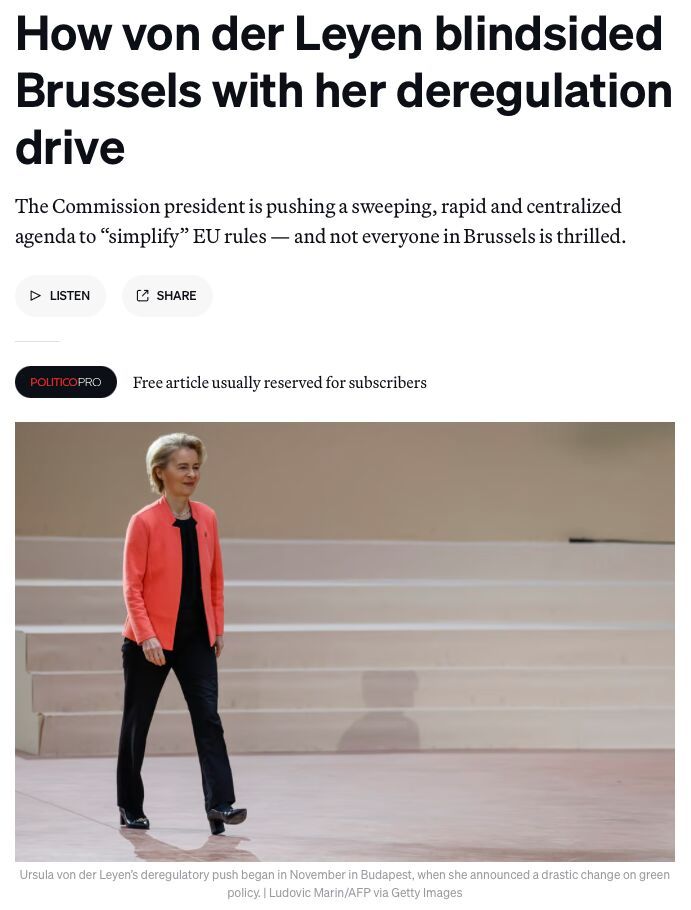

Bart Vandewaetere (Nestlé) puts it bluntly in this POLITICO article: “The European Union unfortunately has lost some trust in the boardrooms by making simplifications that are maybe undermining predictability.”

While most businesses support simplification in principle, many are frustrated by the constant back-and-forth - and by reforms that often complicate things. The result? Greater uncertainty and delayed decisions...

The bottom line: "The risk is that the EU will shoot itself in the foot by making it harder for companies to invest in the region, which is essential for competitiveness."

Competitiveness ultimately rests on trust - and trust depends on predictability. If the EU wants to remain an attractive place to invest, it must be a stable and reliable partner for business...

27-12-2025

“If we lose our identity, our values, the confidence of our people, we will not be in a position to negotiate anything or to bridge anything.”

This is the core risk. When simplification starts to undermine Europe’s identity, its foundational values, and our trust in institutions, simplification itself turns into a liability. The endless back-and-forth on sustainability regulations is a case in point: companies increasingly lose trust in regulatory predictability.

Ribera is explicit: “As Europeans, we cannot bet on a race to the bottom." Yet some of the regulatory rollbacks, delays, and shortcuts point precisely there. We may temporarily appease Washington and others, but at the cost of public confidence.

👉 The challenge for the EU is not less regulation, but better regulation. Not just rolling back and delaying, but smarter design, stronger enforcement, and credible implementation of the rules we already have.

24-12-2025

However, the upcoming "Simplification Review", which is due on 30 April 2026, introduces new uncertainties. The review will analyse the "administrative burden and impact of the Regulation, in particular for micro and small operators." (see p. 3, para 14)

While there is legal certainty, many companies have already made substantial, good-faith investments to comply. These stranded investments have barely featured in the policy debate.

This delay rewards the laggards...

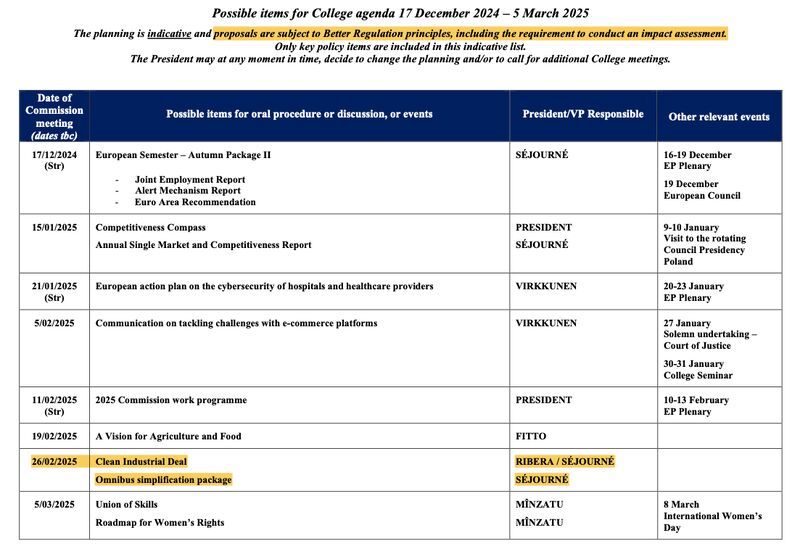

19-12-2025

On the simplification side, we will see the adoption of the revised ESRS following a consultation period. There will also be the "Simplification Review" of the EUDR by the end of April, and the Taxonomy will see amendments to their Delegated Acts.

Omnibus I (CSRD & CSDDD) will move into national transposition, and it will be interesting to watch how Member States put the revised Directives into national law. The "Environmental Omnibus" will keep us busy in 2026, as it contains changes to key environmental laws (e.g. industrial emissions standards).

👉 Beyond simplification, the EU is expected to present its long-awaited Circular Economy Act, aiming to create a genuine Single Market for secondary raw materials. The Climate Resilience Framework will also be unveiled and is expected to constitute a comprehensive policy package.

In short: plenty to watch, plenty to shape - and it is not all about simplification...

===

Note: This overview is not exhaustive and timelines are tentative. For example, it does not include the Green Claims Directive, whose future remains uncertain.

17-12-2025

The EPP continues to deny any formal cooperation with far right groups. But it is crystal clear that there is strong alignment - also because the EPP depends on far-right votes to roll back sustainability regulations.

Concerning is the newly introduced “simplification review”. The European Commission must conduct such a review in early 2026 and propose potential changes to the EUDR. This extends regulatory uncertainty well into 2026.

👉 Delays create uncertainty. Uncertainty undermines investment, preparedness, and credibility. And yet some politicians want to make us believe that all of this boosts competitiveness...

16-12-2025

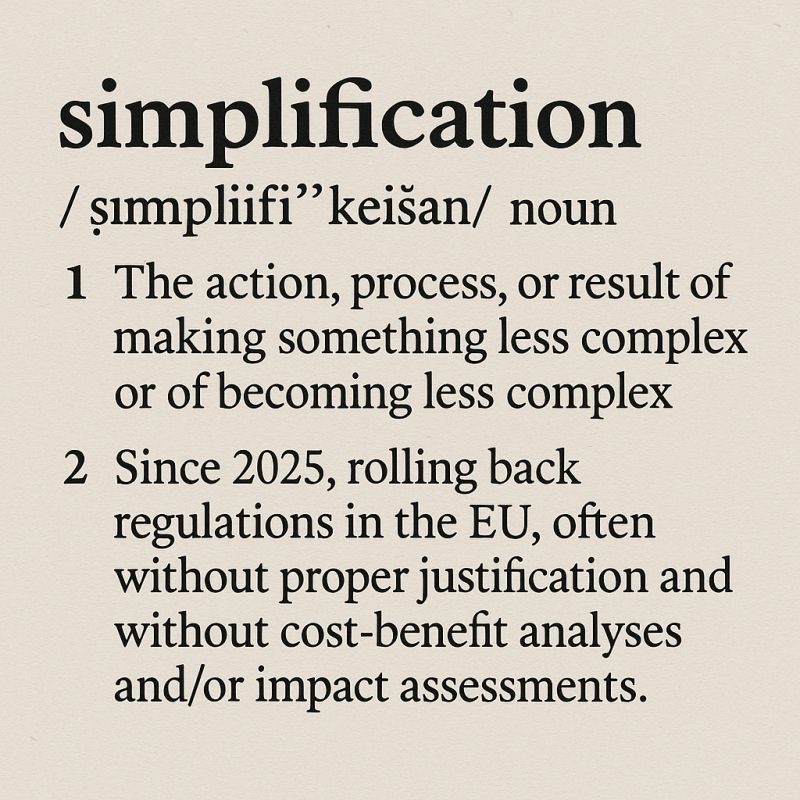

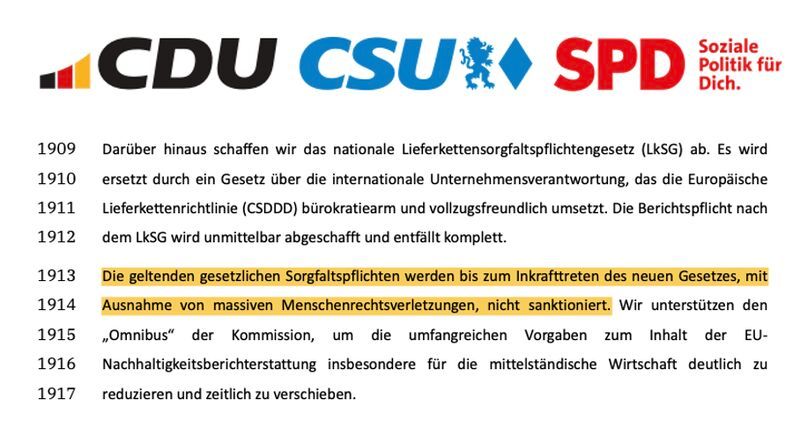

1️⃣ The core problem: wrong assumptions (sustainability undermines competitiveness) and lack of balance (focusing on costs, sidelining benefits).

2️⃣ People lost jobs and many firms supporting CSRD/CSDDD struggled. This was never much discussed/acknowledged - and yet it is also an outcome!

3️⃣ Simplification was needed – e.g. reducing ESRS data points made sense. But simplification turned into a simplified debate that produced deregulation.

4️⃣ The EU has lost trust along the way. I talked to many companies that will navigate EU regulations in a less proactive way in the future.

5️⃣ Policymakers reduced scope by 90% (CSRD), deleted transition plans, and scraped civil liability. And yet they sell this as a "balanced outcome".

6️⃣ Something positive? Firms can no longer just play the compliance card – reflections on the purpose of voluntary action are needed now.

7️⃣ The EPP’s reckless “take-it-or-leave-it” negotiation tactic opened the door widely for far-right political groups to influence European politics.

8️⃣ While swift political action is appreciated, here it came at the expense of rigour. The EU Ombudswoman called it “maladministration”.

9️⃣ I am looking forward to “boosted EU competitiveness” and increased investments. I - and others - will monitor what the Omnibus ultimately delivers.

🔟 ❗ I am deeply grateful for the many excellent discussions here on LinkedIn. I learned a lot from your stories and perspectives - and this is what matters…

15-12-2025

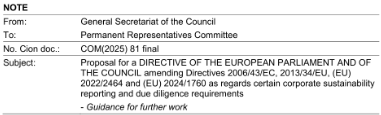

The complaint concerns Mr Warborn’s failure to declare a potential conflict of interest between his role as President of SME Europe, a registered lobbying organisation, and his position as Rapporteur for the Omnibus I package. The complaint argues that this possible conflict was not disclosed in the mandatory transparency form upon appointment as Rapporteur on 20 March 2025.

Specifically, the complaint notes: “As President of SME Europe, Mr Warborn could be expected to represent the organisation’s interests, which may call into question his impartiality and objectivity in the performance of his duties as rapporteur and lead negotiator for Parliament on the report on certain corporate sustainability reporting and due diligence requirements (2025/0045(COD)).”

While no conflict of interest has been formally established at this stage, the seriousness of the allegation warrants careful scrutiny.

The timing is particularly troubling. These developments come on the eve of the final Omnibus I vote in Parliament, raising legitimate concerns about governance, accountability, and trust in the legislative process...

13-12-2025

Manfred Weber (EPP) stated: “From 2035 onwards, a 90% CO₂ reduction will now be mandatory for car manufacturers’ fleet targets, instead of 100%.” There will also be no 100% target for 2040.

The arguments? We must remain “technologically open” and “let consumers decide”. But, in reality, the European automotive industry is seeking to shield legacy business models because they are outpaced by global competition.

Right now, this deal is not backed by pro-European forces. Hence: the EPP will need to rely on their new far-right partners to vote this through.

👉 Regulatory predictability is so badly missing in EU politics! How should businesses work towards the green transition if regulations turn into moving goalposts?

11-12-2025

➡️ Exemptions for livestock and aquaculture operators from reporting on material and energy use, thereby reducing transparency in sectors with significant environmental footprints.

➡️ Scaling-back of Environmental Management Systems (EMS) - the tools that set environmental objectives, track performance and drive continuous improvement at industrial sites.

➡️ The proposed changes on Extended Producer Responsibility (ERP) seem like a good idea and might indeed make things more efficient and streamlined. On the other hand, the possible changes to the Water Framework Directive are problematic.

👉 Once again, the Omnibus arrives without an impact assessment, despite severe criticism from the EU Ombudswoman about this practice.

👉 Once again, simplification is framed solely in terms of compliance costs, with little consideration of the economic toll of pollution, degraded ecosystems and delayed transition efforts.

👉 Once again, it reopens legislation that was only recently revised, including the 2024 update of the Industrial Emissions Directive.

11-12-2025

The compromise text provides clarity on several outstanding issues. Notably, Paragraph 19aa further elaborates the review clause for the #CSRD scope, and the text also clarifies the “transition exemption” for Wave 1 companies that will fall out of scope for FY2025 and FY2026.

The file will next move to the Parliament's plenary on 16 December. Approval there is likely but not a "given" - it will depend on evolving political dynamics and how political groups assess the negotiated outcome.

If approved by Parliament, the #Omnibus I package is formally adopted and hence becomes law (after publication in the "Official Journal").

10-12-2025

The new CSRD will have around 4,800 firms in scope throughout the EU, while the revised CSDDD will apply to a bit more than 1,000 companies. This neither reflects "balance" nor does it make anything "simpler".

For the CSRD we even go below the NFRD threshold. With this we destroy regulatory consistency, something that many investors and businesses have explicitly criticized.

👉 It would be good if political leaders were at least honest and use the word that they have tried to avoid over the last ten months: deregulation...

The accompanying statement by Morten Bødskov (Danish Minister for Industry, Business and Financial Affairs) captures the core problem: the #CSRD and #CSDDD are wrongly portrayed by some politicians as distractions from the real ("core") business of companies.

The implicit message is clear: now that we have freed most businesses from these rules, growth, competitiveness and investment will return. But there is no evidence for this claim.

Europe’s growth challenges stem from structural factors, ranging from high energy prices to gaps in technology scaling. Rolling back 90 percent of the CSRD and 70 percent of the CSDDD will not fix these problems. What it will do is undermine transparency, weaken risk management, and reduce the EU’s ability to compete on standards and trust.

This rollback is "easy politics". Building a competitive Europe looks differently...

09-12-2025

The accompanying statement by Morten Bødskov (Danish Minister for Industry, Business and Financial Affairs) captures the core problem: the #CSRD and #CSDDD are wrongly portrayed by some politicians as distractions from the real ("core") business of companies.

The implicit message is clear: now that we have freed most businesses from these rules, growth, competitiveness and investment will return. But there is no evidence for this claim.

Europe’s growth challenges stem from structural factors, ranging from high energy prices to gaps in technology scaling. Rolling back 90 percent of the CSRD and 70 percent of the CSDDD will not fix these problems. What it will do is undermine transparency, weaken risk management, and reduce the EU’s ability to compete on standards and trust.

This rollback is "easy politics". Building a competitive Europe looks differently...

09-12-2025

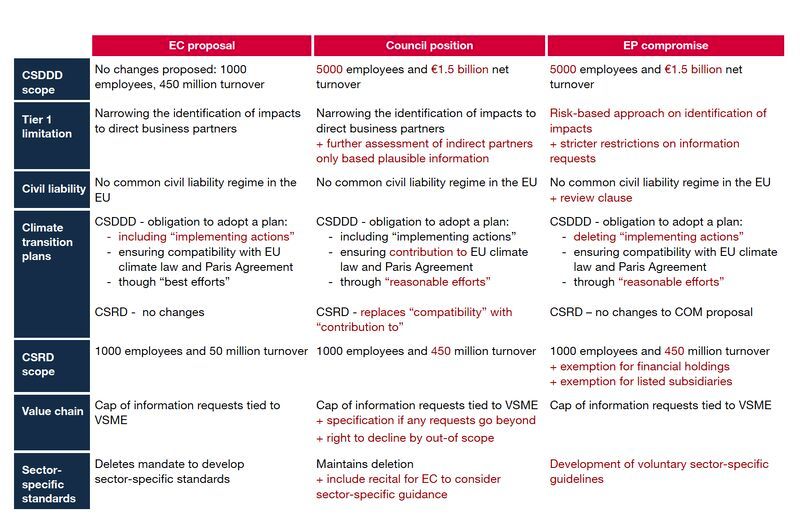

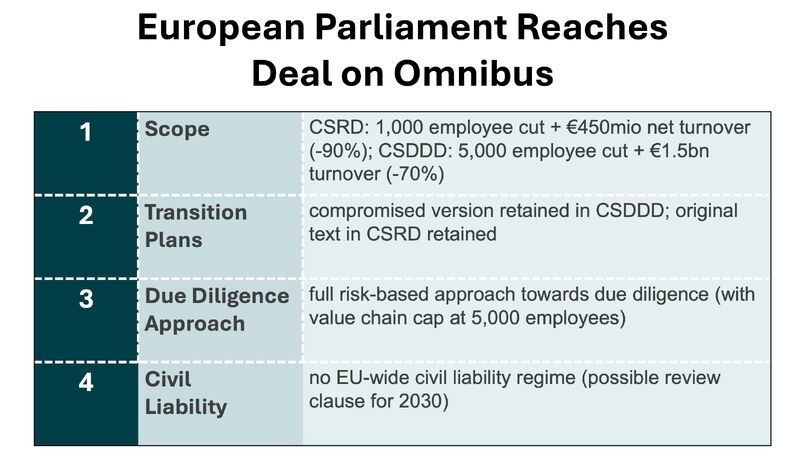

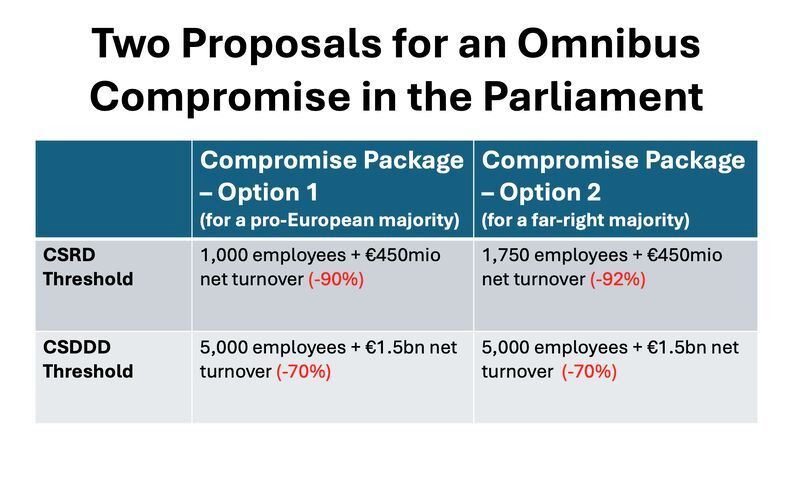

1️⃣ CSRD Scope: 1,000 FTE and €450mio net turnover - this is a dramatic 90% scope reduction.

2️⃣ Review Clause: Importantly, the agreement "introduces a review clause concerning a possible extension of the scope for both CSRD and CSDDD." This shows that policymakers have doubts about the severe scope reductions.

3️⃣ Climate Transition Plans: removed from CSDDD.

4️⃣ Due Diligence Approach I: The exclusive focus on tier-1 companies is removed. Firms should "focus on the areas of their chains of activities where actual and potential adverse impacts are most likely to occur." No comprehensive mapping is needed any longer, only a scoping exercise.

5️⃣ Due Diligence Approach II: The agreement introduces lots of flexibility. When "adverse impacts [are] equally likely or equally severe in several areas, [firms] are given the ability to prioritise assessing adverse impacts which involve direct business partners." This is an indirect invitation to not address severe impacts - if an impact is severe, it must be addressed. This is the whole point...

6️⃣ CSDDD Transposition is pushed back by yet another year. Companies now have to comply by July 2029. Delay, delay, delay...

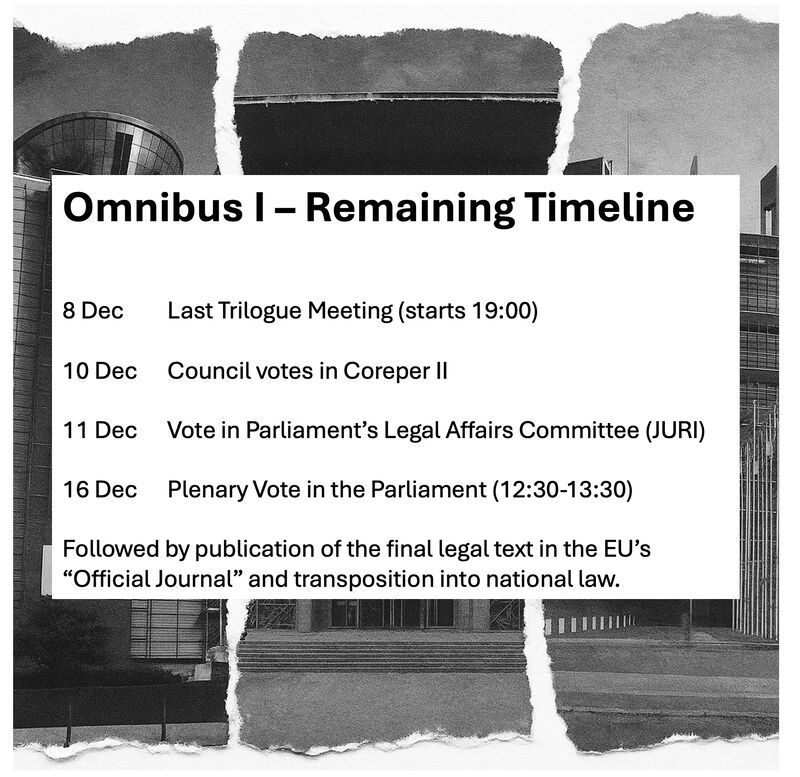

📅 This deal needs to be confirmed: 10 Dec (vote in Coreper II, Council); 11 Dec (vote in JURI, Parliament), 16 Dec (vote in plenary, Parliament).

👉 With this deal it seems likely that the EPP will get the support of far-right political groups (which they formed an alliance with on this file).

This deal confirms the disproportional, non-evidence based rollback of the #CSRD & #CSDDD. Seeing both regulations only as cost drivers and framing them as a competitive disadvantage may appease populist sentiments, but it is not a winning strategy for the future of Europe...

08-12-2025

Today's trilogue meeting kicks off at 19:00, which means we can expect clarity either late tonight or early tomorrow. Usually, it is the Council that communicates trilogue results.

Later this week, both institutions move quickly to validate the deal: 10 December: Council confirmation in Coreper II and 11 December: Vote in the Parliament’s Legal Affairs Committee (JURI). The final adoption in the Parliament's plenary is planned for 16 December.

👉 One key question hanging over the process: Will far-right groups continue to back the agreement, especially if changes may not align with their political interests (e.g. if climate transition plan requirements remain in the CSDDD)?

08-12-2025

These findings are based on input from 200+ companies, investors, and NGOs, providing a broad view across the market.

👉 Competitiveness effects are assessed as neutral. Companies themselves do not seem to think that significant competitiveness effects are created through ESRS simplification. A welcome reality check for all those politicians who are selling simplification as the way to boost competitiveness.

The study also acknowledges “possible downsides from reduced information,” though it argues these may be “partly offset by improved usability.” With the revised ESRS cutting 70% of data points, this feels like a rather optimistic conclusion...

05-12-2025

➡️ The Commission is tasked with a simplification review (by 30 April 2026). Objective: assess the EUDR’s impact and administrative burden. If needed, the review is accompanied by a new legislative proposal. This introduces additional uncertainty as no one knows how much the rules may change.

➡️ Only the operator who first places the product on the market will be responsible for submitting the due-diligence statement.

➡️ Simplified one-time declaration for micro and small primary operators. They will submit such a simplified declaration and receive an identifier for traceability.

👉 Once again, policymakers delay without compelling evidence that a delay is necessary. Many companies have taken the opposite position, asking the EU to stick to the application date for the sake of certainty and investment stability.

👉 The Commission now faces an awkward task: conducting a simplification review of a regulation that has not yet been implemented. As we saw with the #CSDDD, this "simplification-before-implementation" approach lacks the data to make sound judgements.

📅 Council and Parliament now need to formally adopt this deal before it enters into force by the end of the year. The Parliament vote is on 16 Dec.

04-12-2025

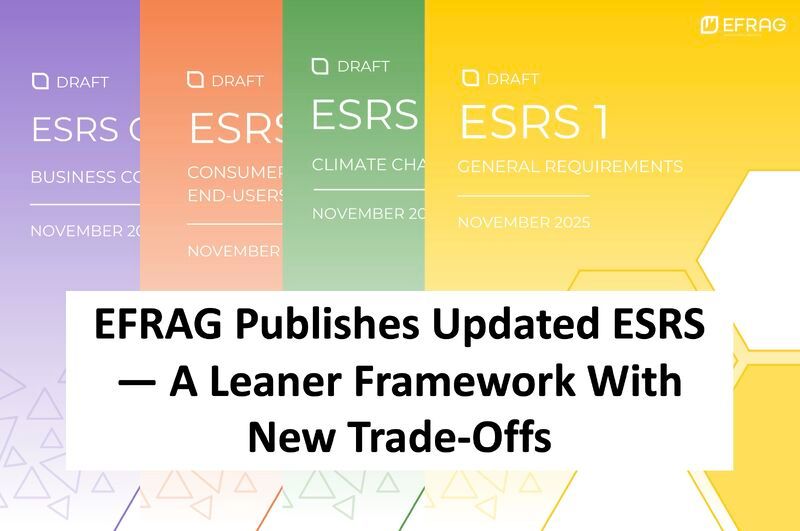

➡️ The reduction in data points was overdue, yet whether 70% is the right balance is far from clear. Yes, redundant and low-value data points are gone, but so are several data points that mattered.

➡️ The revised Double Materiality Assessment promises "clearer guidance, less documentation, and better alignment with audit expectations." Given the friction around the original DMA, this feels like progress on proportionality.

➡️ Many exceptions and reliefs - such as the possibility to omit information when there is "undue cost or effort" - introduce a lot of flexibility. Without tighter guardrails, these reliefs risk creating loopholes for greenwashing. Reliefs should be the rare exception, not the norm.

👉 EFRAG’s mandate was tough: deliver major simplification without diluting the standards, and do it under time pressure. Not exactly a recipe for a quick win. The final package reflects those tensions: a step forward in some respects, a compromise in others.

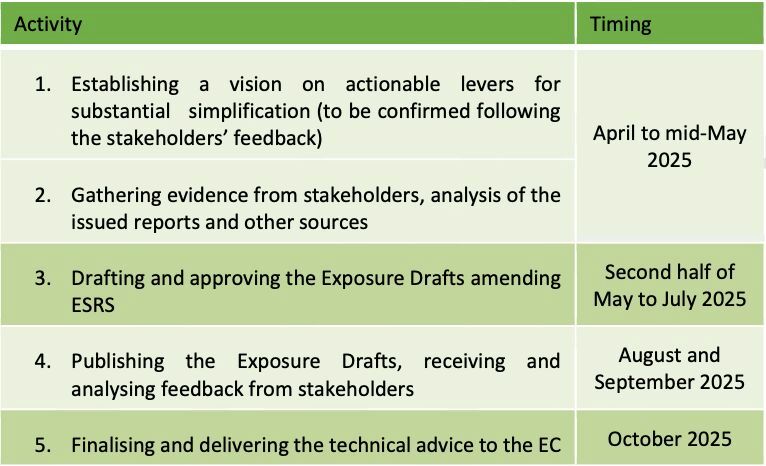

The revised ESRS are now with the Commission, which will consult internally and externally and engage with Parliament & Council. This is expected to take six to nine months, after which the standards will be adopted through a Delegated Act.

The objective is for the revised standards to apply from FY 2027, with a possibility for earlier application for FY 2026 (still to be confirmed).

03-12-2025

This vote is to confirm the outcomes of the trilogue negotiations, a crucial step toward regulatory certainty. The EUDR trilogue will be on 4 December, while the last date of the Omnibus trilogue is set for 8 December (per the original schedule).

It will be interesting to watch whether far-right groups continue to back the Omnibus if the trilogue outcome deviates from the Parliament’s compromise - for example, if climate transition plans are not fully removed from the CSDDD.

01-12-2025

In my own research (drawing on ongoing interviews), I have so far encountered five interconnected motivations for "voluntary action post-omnibus":

1️⃣ EXPECTATIONS: Many firms realize that while CSRD/CSDDD change, stakeholder expectations do not change - particularly from business partners, investors, and banks. These expectations act as "pressure points"...

2️⃣ FORESIGHT: Some firms do not yet face these expectations, but they anticipate them based on their observation of the broader market environment and the behaviour of their competitors.

3️⃣ VALUE CREATION: Some firms recognise the business value related to voluntary action: stronger risk management, clearer governance, and better decision-making through improved data and processes.

4️⃣ COMMUNICATION: Others see voluntary action as a way to develop and sustain a shared language on sustainability in the organization which allows for better collaboration and coordination.

5️⃣ VALUES: Some companies push for voluntary action as a natural expression of their organisational values, especially in family-owned firms where values are often strongly lived.

How firms view voluntary action depends on their prior experiences (e.g. with NFRD/CSRD) and past investments in relevant systems. For instance, value is more difficult to see without any implementation experience.

👉 All of this has significant implications for business education. We still teach too much compliance... I started to do my share. We revised our "Sustainable Business Transformation" program at CBS Executive (delivered with IMD). We do not discuss regulations as legal demands, but as frameworks for managing expectations, business value, and corporate values...

===

Link to our Program: https://lnkd.in/dD27978k

28-11-2025

She argues that the upcoming trilogue will determine whether the EU “remains a rulemaker or becomes a rule taker in a system shaped elsewhere.” While much of the package may leave little room for renegotiation (given Council and Parliament alignment), she is right to point out that there is still space for a meaningful course correction in some areas, especially climate transition plans.

Highlights of her arguments:

➡️ "Several major economies are now following in Europe’s footsteps, mandating transition plans and introducing demanding climate disclosure rules. [...] But we cannot defend this approach if we stop measuring it, weaken traceability, or discard the tools that allow us to verify compliance."

➡️ "Reliable, high-quality and easily comparable information is the foundation on which companies design credible strategies, investors assess risks and financial supervisors fulfil their mandates. Without it, banks and asset managers would slide back to the era before sustainable finance, when they had to approach companies individually for data."

➡️ "Europe can and must simplify rules where necessary, reduce unnecessary burdens and improve consistency. But giving up on transparency, reliability and diligence [...] is not simplification. It is self-harm. Europe has always competed through high standards, innovation and quality of life."

👉 Ribera’s intervention sends an important signal: Europe can still make (some) choices, e.g., on climate transition plans. It is vital that the European Commission pushes for progressive positions during the trilogue...

27-11-2025

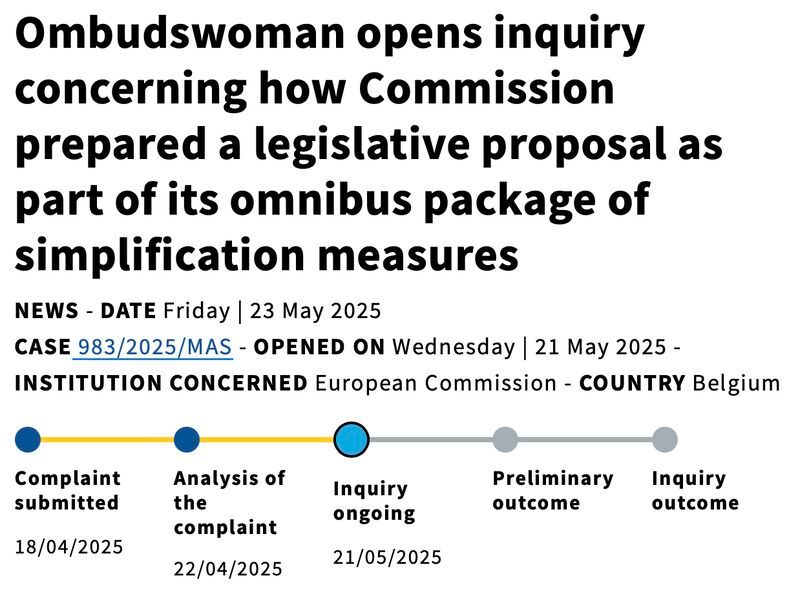

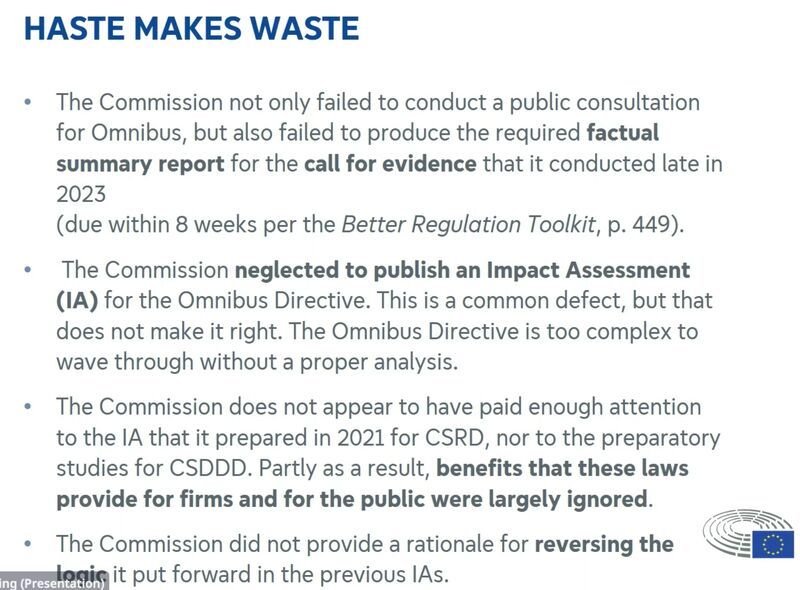

The inquiry confirmed several problems, including: (1) the insufficient justification for the urgency of the Omnibus (and two other proposals) and (2) inadequate documentation of why internal law-making rules were bypassed.

The press release stresses: “The Commission must be able to respond urgently to different situations […] However, it needs to ensure that accountability and transparency continue to be part of its legislative processes and that its actions are clearly explained to citizens. […] Certain principles of good law-making cannot be compromised even for the sake of urgency.”

Background: Earlier this year, the Ombudswoman – an independent oversight body in the EU system – received a complaint alleging that the Commission had not followed its own guidelines while preparing the Omnibus I proposal. These guidelines are meant to safeguard evidence-based, transparent, and inclusive legislative proposals.

❗While the Ombudswoman has no formal legal powers, her assessments carry significant weight. She issued several recommendations, above all that the Commission must in the future "ensure a predictable, consistent, and non-arbitrary application of Better Regulation rules."

👉 Today's outcome confirms what many have highlighted since February 2025: the Omnibus I process faces major procedural shortcomings, including the absence of a proper impact assessment and stakeholder consultation.

===

Press Release: https://lnkd.in/d2K7k-JZ

27-11-2025

While the #Omnibus debate continues to fixate on compliance costs, this study highlights the multidimensional benefits that reporting can unlock. At its core, the research identifies a value pathway:

1️⃣ TRANSFORMATION PROCESSES that reporting can trigger - including building more robust governance structures, professionalising and systematising processes that would otherwise remain ad hoc, and fostering deeper internal collaboration and stakeholder engagement.

2️⃣ TANGIBLE OUTCOMES enabled by these processes - such as improved access to capital, stronger risk management, better customer and client acquisition, and increased employer attractiveness.

Of course, whether these processes and outcomes materialise depends on firm-specific conditions (e.g., resources) and external factors (e.g., competitive pressure). There is no automatic value creation.

The study draws on a review of extensive empirical academic literature and new qualitative insights from interviews.

👉 In short: this should be mandatory reading for anyone who sees only bureaucracy and cost, while overlooking short- and long-term benefits.

It is exactly this cost-benefit balance that the simplification debate needs...

===

Kudos to the author team: Dr. Manuel Reppmann, Judith Stroehle, Laura Marie Edinger-Schons (financed by Bertelsmann Stiftung).

26-11-2025

With today’s vote, the Parliament and Council positions now largely converge, making both the delay and a EUDR review in 2026 highly likely.

What today’s decision means:

➡️ New application dates: 30 December 2026 for medium and large operators; 30 June 2027 for micro and small operators

➡️ A Commission review assessing the EUDR’s “administrative burden” by April 2026, to be followed by a legislative proposal, if deemed necessary.

👉 This outcome is out of step with business reality. Companies have already invested heavily in systems, expertise, and supply-chain transparency. Yet politicians delay based on ideology rather than evidence. The message to companies is clear: invest at your own risk, because regulatory stability can no longer be taken for granted.

Let’s be clear: What we are witnessing is the emergence of an informal structural cooperation between the EPP and far-right groups. We saw it during the #Omnibus vote. We saw it today. And we will see it again.

📅 Trilogue negotiations will happen in the next weeks to agree on a final legal text before the end of the year.

24-11-2025

The justification for the delay remains remarkably thin. The EPP's amendment states: "This is necessary in order to allow third countries, Member States, operators and traders to be fully prepared." Interestingly, no evidence was given on the lack of preparedness, so it is more an assumption than a fact.

👉 The EPP insists it is not directly negotiating with far-right groups, but the real issue is the EPP’s refusal to compromise for a centrist majority - effectively ensuring that only a right-wing majority is possible. Once again, we see a “take it or leave it” approach rather than genuine coalition-building.

The far-right tasted power with the #Omnibus vote. On Wednesday, we may see history repeating itself...

22-11-2025

If the EPP manages to secure support from far-right groups, a majority for both the delay and a review clause becomes almost certain. Such a clause could reopen the regulation as early as April 2026.

Talks on Friday between the EPP, S&D and Renew failed. Unless the pro-European groups still find common ground, we are heading toward another vote where conservatives and far-right groups move together. It is the same dynamic we saw during the #Omnibus vote on 13 November.

👉The economic costs and uncertainty resulting from this approach, marketed as ‘simplification’, are considerable. Unsurprisingly, companies have little choice but to adopt a “wait-and-see position” amid the ongoing instability...

20-11-2025

1️⃣ Entity-level PAI disclosures: Most financial market participants will no longer need to report entity-level PAIs.

2️⃣ Product-level disclosures: Disclosures will focus on data that is "available, comparable, and meaningful", aligned with the three new product categories and easier for retail investors to interpret.

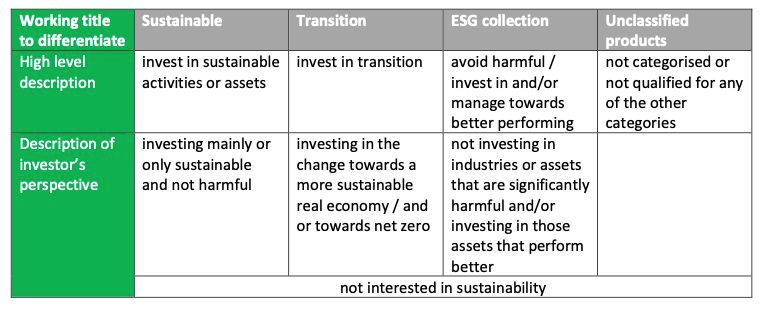

3️⃣ A three-tier product categorisation system: (1) Sustainable: products contributing to sustainability goals and meeting high sustainability standards, (2) Transition: investments backing credible environmental or social improvements.(3) ESG Basics: broader ESG approaches without meeting the first two categories.

All categories must channel 70% of the portfolio into the stated sustainability strategy and exclude harmful activities (e.g., tobacco, prohibited weapons).

And importantly: “ESG” claims in product names and marketing will be reserved for categorised products, a step to restore trust and curb greenwashing.

👉 Let’s hope Parliament and Council now move it forward constructively, without watering it down under vague notions of “competitiveness.”

20-11-2025

▶️ New application dates: 30 December 2026 for medium and large operators; 30 June 2027 for micro and small operators

▶️ Only the operators who first place a product on the EU market would be required to submit due-diligence statements.

▶️ Downstream operators and traders would no longer need to file separate due-diligence statements.

▶️ Micro and small primary operators would only need to provide a one-off simplified declaration

👉 On top of this, the Council asks the Commission to conduct a “simplification review” by 30 April 2026 to evaluate the EUDR's impact and administrative burden. Where appropriate, the review should be accompanied by a new legislative proposal.

But: How can policymakers meaningfully assess the impact and ‘burden’ of a regulation that hasn’t even entered into force? The review, again, creates uncertainty and unpredictability as the outcome is unclear...

📅 The Parliament will vote on 26 Nov (12:00-13:00), but it seems pretty clear that changes will go beyond the Commission’s original proposal...

19-11-2025

But Member States remain split. Germany, Sweden, Hungary, Austria and the Baltic States want deeper simplification (not just a delay). France, Spain, Belgium and the Netherlands are pulling firmly in the opposite direction.

The EUDR is on the Coreper I agenda (Council) today. We will see whether a review clause becomes the acceptable middle ground (qualified majority is needed).

Meanwhile, companies are increasingly vocal, and frustrated. In a letter published Monday, Nestlé, Danone, Mars and others warn that another delay would penalise early movers, writing that it would create “substantial sunk costs … and reward the laggards.” Hard to disagree.

Adding to the pressure, a new ClientEarth legal opinion argues that a further delay could breach “legal obligations under the EU treaties, general principles of EU law, and international law on State climate obligations.”

In short: a regulatory mess with barely a month left to solve it.

17-11-2025

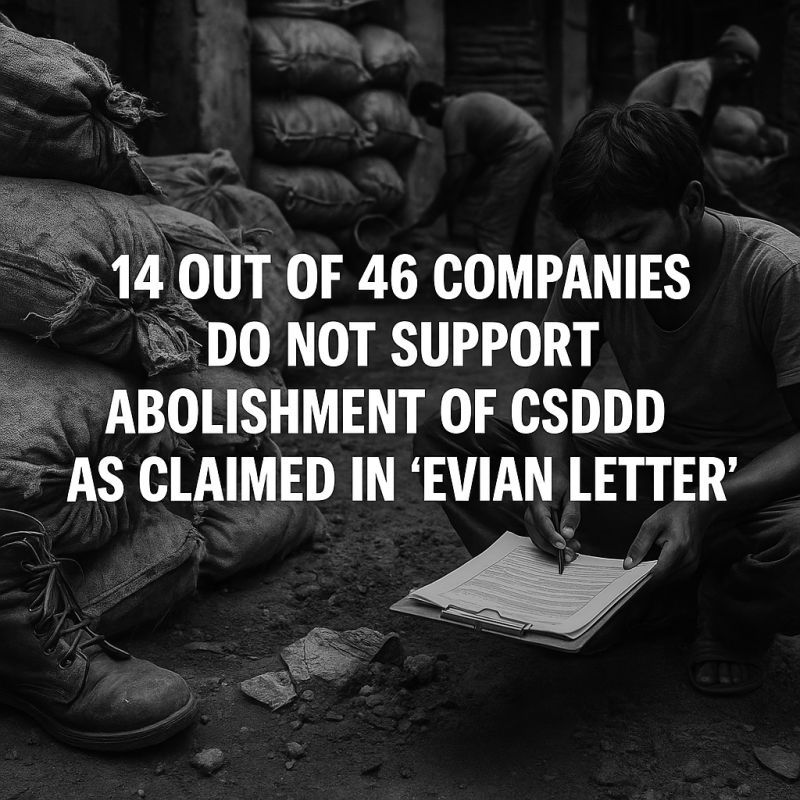

A bit of context: In October, a letter was sent to Merz and Macron calling for the complete removal of the CSDDD. It was signed by the CEOs of Siemens and TotalEnergies, who asserted they were speaking “in the name of” all 46 CEOs attending the German-French Evian Summit.

The subsequent reactions from companies tell a very different story, and highlight how easily lobbying efforts can overreach or misrepresent.

➡️ SAP said the letter “was not aligned” with their position.

➡️ Bpifrance’s CEO stated he “did not see it before it was published.”

➡️ Amundi stressed they “neither participated nor signed the letter.”

Most of the remaining firms (e.g. BMW Group, Danone, BASF) clarify that while they support simplification, they are not in favour of fully abolishing the CSDDD, as the letter suggested.

👉 Bottom line: The gap between what was claimed and what companies actually stand for is significant. Lobbying cannot be based on "wishful thinking".

Transparency in advocacy matters, and we have too little of this, especially in the context of the ongoing #Omnibus discussions...

14-11-2025

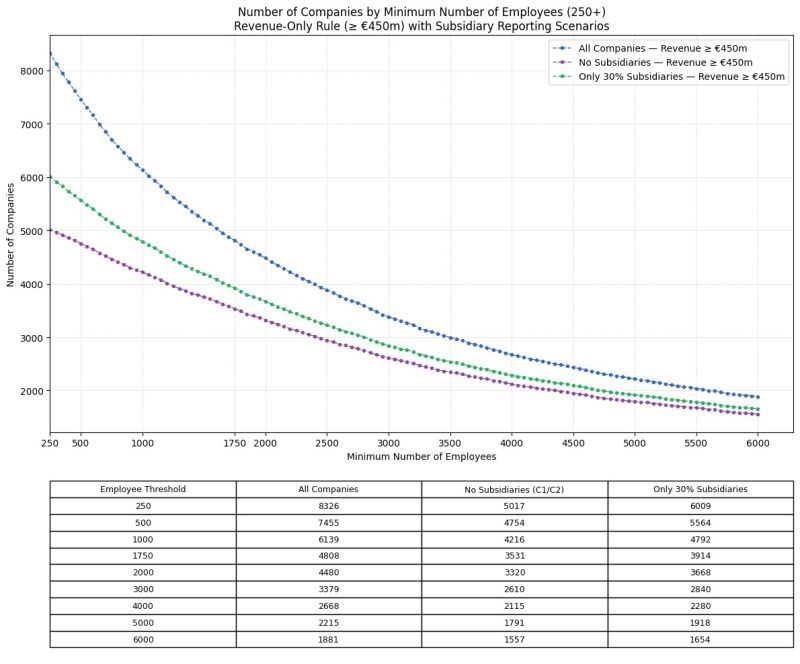

1️⃣ #CSRD scope: The gap is still pretty significant: 4,792 firms in scope under the Council vs 3,914 under Parliament, assuming a 30% subsidiary reporting rate. This amounts to choosing between 90% or 92% scope reduction.

2️⃣ Climate transition plans – key sticking point. How will the institutions bridge the data gap? Both investors and the ECB have flagged serious concerns about data availability. But Member States have an appetite for simplification these days (see the discussions around the further delay of #EUDR).

3️⃣ Civil liability – aligned (but not in a good way). The alignment will make the #CSDDD even more toothless. With the revised scope (5,000 employees / €1.5bn turnover), only around 1,300 companies across the EU would be in scope.

During trilogues, the EU’s informal yet crucial negotiation phase, there are two co-legislators: the Parliament (representing citizens) and the Council (representing Member States). The Commission acts as a facilitator, supporting the co-legislators in their work, with a view to reconciling their positions.

👉 The #Omnibus is taking shape, but the resulting negotiation position shows clearly: the EPP’s decision to side with the far-right is a serious warning sign for anyone invested in a credible sustainable transition...

13-11-2025

This means: (1) #CSRD threshold at 1,750FTE / 450 mio turnover (-92% of firms); (2) complete deletion of climate transition plans; and (3) no EU-wide #CSDDD civil liability (and also no review clause).

Just seven months ago, Manfred Weber (EPP Chair) said: "As a leader, I defined a clear red line to the extremists, we will never work together with those who are not respecting my three pro's: pro Ukraine, pro rule of law and pro Europe, these are fundamental things for us."

Mr Weber's red lines seem to fade very quickly.

For the first time, a major legislative file goes to trilogue on the back of an EPP and far-right alliance. This sets a dangerous precedent. The Omnibus is only the first of several packages ahead - and we may be witnessing the start of a systematic rollback of key European legislation based on this alliance.

A sad day for sustainability - but, above all, a sad day for Europe. 🇪🇺

13-11-2025

Originally, the Commission had proposed a one-year delay only for micro and small operators. The Council now wants to go further: large firms would have until end-2026, while SMEs would get until June 2027.

Despite broad backing for the delay, Member States remain divided on how far simplifications should go. As a result, no official negotiation mandate was agreed. The Danish Presidency will now have to broker a compromise in the coming days.

📅 What’s Next? Later today, the European Parliament will vote on whether to trigger the urgent procedure for the EUDR amendments — effectively fast-tracking the process. The vote on the substance will follow in an upcoming plenary session.

👉 What a mess. While businesses invest to prepare, political indecision keeps moving the goalposts. The result? More uncertainty, less credibility - and growing frustration across the board.

11-11-2025

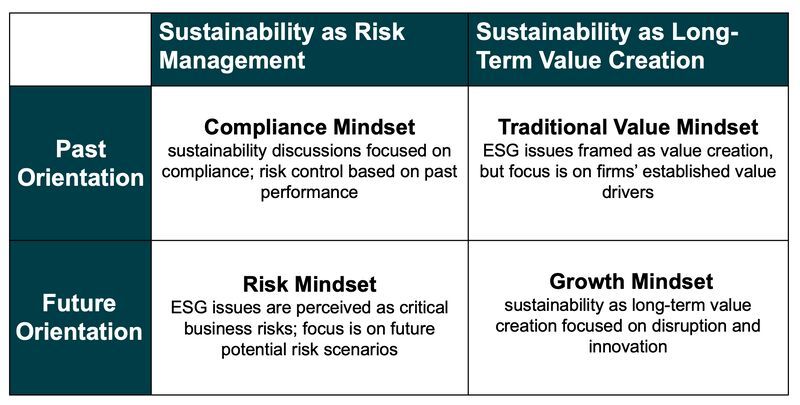

Broadly speaking, firms will fall along a spectrum from proactive to reactive (see image): (1) Some will take initiative and align proactively with existing frameworks. (2) Others will report only when asked, ticking boxes rather than setting benchmarks. Here’s a quick breakdown:

1️⃣ Revised ESRS – Some companies may voluntarily apply the revised ESRS, especially those with mature reporting systems and clear information needs. For many of them, the VSME is too limited.

2️⃣ Voluntary Standards – Others will turn to recognized voluntary standards, most likely the VSME (given the EU’s recommendation). However, GRI or ISSB could appeal to firms with global operations or investor-focused disclosures.

3️⃣ Bilateral Disclosure – Some firms won’t engage in full-fledged reporting at all, but will disclose information only upon request from business partners, banks, or rating agencies.

Of course, reality is rarely this neat. Many hybrids will emerge and a lot will depend on corporate context. Also, the proactive-reactive spectrum is tricky, e.g., because voluntary standards can be used in reactive ways.

Wherever we land with the final #CSRD scope, one thing is clear: voluntary reporting post-Omnibus will look different from the pre-Omnibus era, as market and stakeholder expectations continue to evolve...

===

Thanks to Christian Sparrevohn, Simon Taylor, and Sven Beyersdorff for discussing with me.

10-11-2025

The letter urges the European Parliament’s Legal Affairs Committee (JURI) to first seek an internal legal opinionbefore taking any further legislative steps.

A central concern? Proportionality. Under EU law, legislative measures must be “proportionate stricto sensu”, meaning the benefits must outweigh the negative effects on protected interests. Yet, no impact assessment has been carried out for the Omnibus. Without one, assessing proportionality lacks "sufficient information." And frankly, a 90% reduction in #CSRD scope hardly feels proportionate.

The signatories write: “The proposal to raise CSRD thresholds and exclude listed SMEs lacks a comparative analysis of whether ongoing ESRS reforms could deliver equivalent relief without reducing reporting scope.”

In short, the legal uncertainty around the Omnibus may not disappear even after a final text is agreed...

06-11-2025

1️⃣ New Product Categories

Article 7 – Transition: Funds with ≥70% of assets linked to transition objectives.

Article 8 – Integration: Investments that outperform on sustainability or have a proven track record.

Article 9 – Sustainability Objective: At least 70% of assets in “sustainable economic activities” (e.g. taxonomy-aligned); no investments in expansive fossil fuel companies

Indicators for assessing the three categories will be anchored in the PAIs. The Commission will specify these through a Delegated Act, ensuring consistency with #CSRD disclosure requirements.

2️⃣ Simplified PAI Reporting

Entity-level disclosures scrapped, saving an estimated €56 million.

Product-level PAIs narrowed to fewer key indicators for leaner, clearer reporting.

🗓️ The formal adoption of the #SFDR simplification is expected to be discussed by the College of Commissioners on 19 November.

05-11-2025

This would imply: (1) 1,750 employee / €450 mio turnover threshold for CSRD (-92%), (2) deletion of climate transition plans, (3) no EU-wide civil liability.

POLITICO writes: "During an EPP leaders’ meeting on Tuesday, the group’s president, Manfred Weber, said the group would aim to find a right-wing majority on this sensitive green file given the Socialists & Democrats had failed to support the first compromise, according to three officials with knowledge of the discussions."

It is deeply disappointing to see the EPP turn its back on Europe’s pro-European alliance just to push through short-term political gains.

The EPP’s choice is not just a tactical shift - it is a moral one, and it risks normalizing the far right as legitimate partners in shaping Europe’s future.

04-11-2025

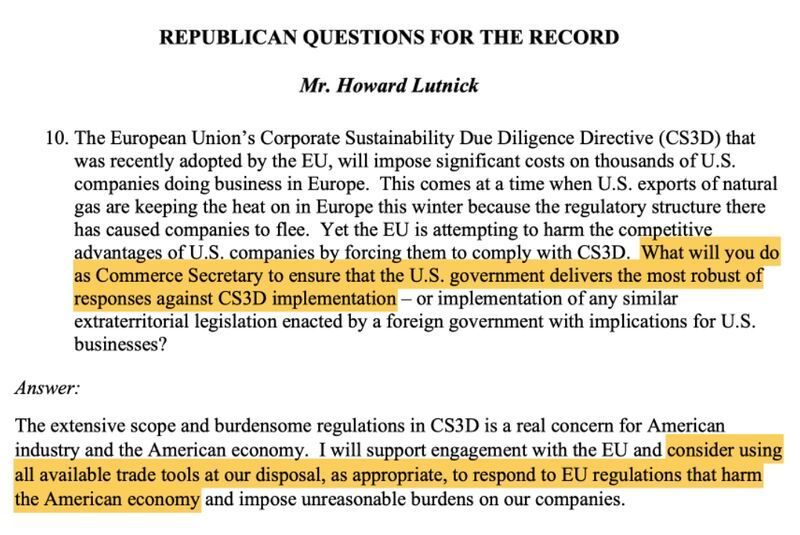

The letter states: “We urge you to immediately comply with America’s laws and the Trump Administration’s policies and disavow the DEI and ESG directives imposed by the CSRD and CSDDD.”

CSRD and CSDDD are labelled “corrosive reporting and compliance directives” crafted by “European elites.” Meta is urged to “not allow bureaucrats in Brussels to direct your company’s policies and operations here in America.”

Let me be clear: this letter demonstrates a disregard for Europe, its institutions, and our legislative system. It amounts to bullying by several U.S. State Attorneys General.

If anything, this letter makes me proud to be European. 🇪🇺

03-11-2025

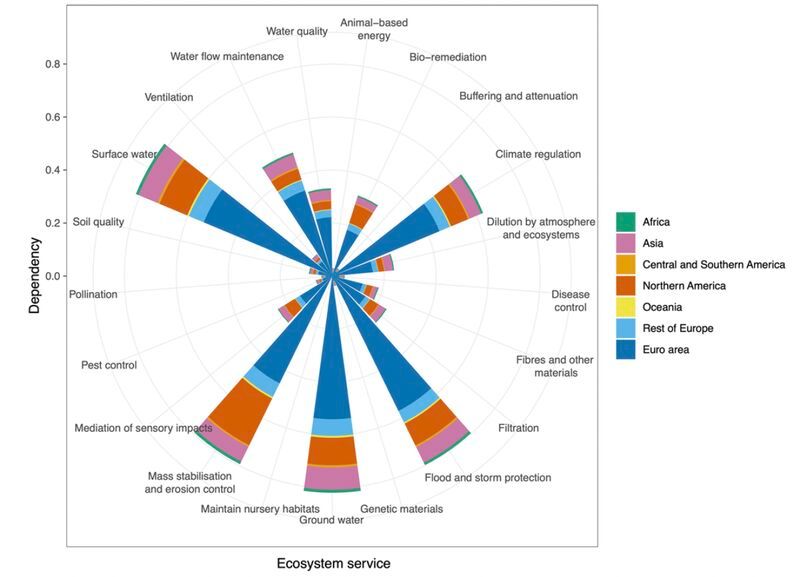

This is exactly why we need a common legal standard for disclosing biodiversity information. Transparency is not red tape - it’s the foundation for credible, comparable sustainability claims.

Yet with the #Omnibus, the EU is rolling back this common framework for 90% of companies that used to be in scope of #CSRD.

The rise in greenwashing risk is also the result of mounting pressure to appear “nature-positive”, pushing some firms toward vague, exaggerated, or misleading claims.

===

Data and report by RepRisk: https://lnkd.in/dxPmgd7K

Note: The light blue line reflects companies linked to both biodiversity and greenwashing risk, the dark blue line records incidents.

31-10-2025

That is a striking shift, and a worrying one. The #Omnibus proposal takes a "broad-brush" approach, cutting across the economy without distinguishing between sectors that are key to the green transition.

Take construction and real estate: both would see major reductions in reporting obligations, even though high-quality sustainability data from these sectors is essential for investors assessing climate risks and for steering capital towards transition efforts.

👉 A more nuanced, sector-sensitive approach to defining the revised CSRD scope would have been far more effective. So far, “simplification” has been achieved through a simplified debate, one that overlooks where sustainability information really matters most...

===

Thanks Theodor Cojoianu, Andreas Hoepner, and Fabiola Schneider for the collaboration.

29-10-2025

That change might sound technical, but it is not. It would exempt roughly 900 more companies, leaving only about 3,900 firms in scope across the EU (assuming a 30% subsidiary reporting rate).

This is why it is vital that centrist political groups find a genuine compromise, one that reflects better the needs of everyone who works with and depends on sustainability information.

👉 Watering down the scope of the #CSRD and #CSDDD to the point where only the very largest companies are covered turns back the clock. In 2025, it is no longer credible to pretend that sustainability and due diligence obligations are the preserve of a few giant firms.

U.S. Senator Henry Clay once said, “A good compromise is when both parties are equally dissatisfied.” We’re not there yet - but we need to be...

===

Thanks to Andreas Hoepner, Theodor Cojoianu and Fabiola Schneider for the collaboration around CSRD scope calculations.

28-10-2025

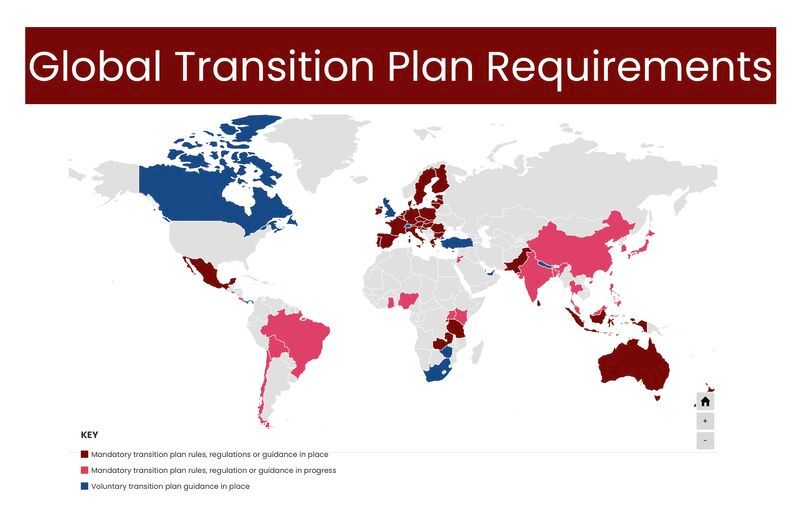

1️⃣ Mandatory adoption of transition plans is becoming the norm: from Australia and Indonesia to Mexico, New Zealand, Pakistan, Sri Lanka, Tanzania, and Zambia.

2️⃣ Momentum is building: by 2025 – 2027, several major economies (Bangladesh, Brazil, China, Ghana, India, South Korea, Thailand) are expected to make transition plans mandatory.

3️⃣ Global convergence: Most new frameworks align with ISSB standards,

though TCFD still features in some.

👉 EU policymakers should take note: Rolling back mandatory transition plans from the #CSDDD (as proposed in the compromise between the EPP and far-right parties) risks letting European companies fall behind in the global race toward credible transition planning.

===

Access the overview: https://lnkd.in/d8inpV4W (by the International Transition Plan Network (ITPN))

27-10-2025

1️⃣ Chancellor Merz called last week’s Omnibus vote “unacceptable” and “a fatal mistake that must be corrected.” Let’s be clear: parliamentary votes are not subject to correction simply because a head of state dislikes the outcome.

Merz also co-signed a letter with several heads of state demanding from Council and Parliament the “swift adoption of CSRD and CSDDD simplification.”

2️⃣ European Parliament President Roberta Metsola recently said: “I’m ready to work with everyone,” hinting at possible cooperation with far-right groups due to changing "political realities".

However, as President, Metsola’s role is not to organise majorities, but to oversee the work of the Parliament and to independently represent it. But the pressure from Member States is very high. In an interview with the Financial Times, she admitted: “We have a letter that was signed by 22 heads of state saying, ‘move, move’. How am I going to translate that into moving?”

👉 Member state pressure is shaping parliamentary behaviour in ways that challenge the balance of power within the EU.

MEPs should focus on delivering a real compromise - one that earns the name - not a deal crafted to please a few heads of state. The next vote is scheduled for 13 November (at 11:00), so still some time...

24-10-2025

It’s been a challenging month for the company. First, the CEO signed a letter to policymakers calling for the repeal of the #CSDDD (including climate transition plans). Now comes a clear conviction for greenwashing over its net-zero claims.

The court found that TotalEnergies misled consumers into believing that it could achieve carbon neutrality by 2050 while increasing oil and gas production. The lawsuit targeted around 40 "false advertisements".

TotalEnergies now has one month to remove misleading references to carbon neutrality and the energy transition, including lines like: “Our ambition is to be a major player in the energy transition while continuing to meet the public’s energy needs.”

👉A landmark ruling and a clear reminder that climate credibility must be earned, not advertised. TotalEnergies wanted a cleaner image, instead it got a clean-up order...

22-10-2025

The Omnibus will now return to the next plenary session (11–13 November) for a full vote. A new deadline for amendments will be set, which could reopen parts of the compromise.

At this stage, the key question is: where will a majority for the amendments come from? Today’s vote suggests that the current centre alliance may lack the numbers to push the current compromise through in plenary.

One thing is clear: an alignment between the EPP and far-right groups would set a dangerous precedent and should be avoided at all costs!

22-10-2025

The letter bluntly states: “Beyond the direct energy security risks, the CSDDD also threatens to disrupt trade and investments across nearly all the EU’s partner economies. Its implementation could jeopardise existing and future investments, employment and compliance with recent trade agreements.”

The CSDDD has been watered down significantly but Qatar’s energy minister, Saad al-Kaabi, told Reuters that further changes are needed, claiming that the current amendments did not address their concerns (mostly penalties and climate transition plans).

👉 It’s frankly disgraceful to see the U.S. and Qatar trying to bully Europe into rewriting its own laws. Europe must stand firm, our sovereignty and regulatory independence are not bargaining chips.

Ursula von der Leyen summarised it well in her State of the Union: “I want to be crystal clear on one point: whether on environmental or digital regulation, we set our own standards, we set our own regulations.”

22-10-2025

For these smaller operators, a postponement until December 2026 - along with a simplified due diligence process - is being discussed. For everyone else, the EUDR is still set to enter into force on 30 December 2025.

EURACTIV reports that this decision was reached during a Commissioners’ meeting earlier today. The Parliament and Council still need to sign off, potentially opening the door for further adjustments.

Interestingly, the IT system issues cited as the reason for the delay do not seem to be so significant after all...

===

Official Commission Statement: https://lnkd.in/dTfvN3cT

EURACTIV story: https://lnkd.in/ddawKcb2

21-10-2025

Background: On 13 October, the JURI Committee not only voted on the Omnibus compromise, but it also voted in favour of entering trilogue negotiations directly without(!) a prior plenary vote.

But this decision is now being challenged by some MEPs who believe that the whole plenary should vote on the compromise (and not just a Committee). It appears likely that the threshold required to contest JURI's decision (10% of MEPs) will be reached.

As a result, it is very well possible that on Wednesday the plenary will vote on whether to confirm or reject the mandate to go directly to the trilogue.

1️⃣ If the plenary confirms the mandate, trilogue negotiations will begin on 24 October.

2️⃣ If the plenary rejects it, the Omnibus will return to the next plenary session (11–13 November) for a full vote. In that case, a new deadline for amendments will be set, meaning parts of the compromise could once again be reopened.

👉 Given the far-reaching nature of the proposed changes, I believe it is both right and fair that the full plenary should decide whether to give this mandate for trilogue negotiations.

20-10-2025

Food drives five of the six breached planetary boundaries, from climate and biodiversity loss to nitrogen, phosphorus, and freshwater use. Food production contributes to nearly one-third of global GHG emissions, e.g. from cattle methane and fertiliser use to deforestation for animal feed.

The report emphasises that this is not just about agriculture, it’s about rethinking an entire system: what we eat, grow, use land, and deal with waste.

👉 But political will to tackle this systemic issue is lacking, the EU is a good example. In 2020, the EU published its "Farm to Fork" strategy as a central pillar of the Green Deal.

But this grand vision has faded into political fatigue, with many flagship measures being delayed or not moving forward (e.g., the legislative framework for sustainable food systems that was planned for 2023).

The message is clear: food systems are both a major part of the problem, but can also be a major part of the solution (given that politicians and consumers are ready to change behaviour).

===

EAT-Lancet Report: https://lnkd.in/dfFHKWZ3

18-10-2025

According to POLITICO, some signatories now claim they were “encouraged to write it" by their national governments. That is quite remarkable, because with this the CEOs shift the blame for their demands onto Berlin and Paris.

Meanwhile, the CEO of Bpifrance has made it clear he does not consider himself bound by the letter, also because he did not even see the letter before it was published. Yet, the CEOs of Siemens and TotalEnergies wrote the letter "in the name of" all 46 participants at the Evian Summit.

Deutsche Börse still stands by the letter - their spokesperson said the company “supports the contents.” Bosch, too, has not distanced itself from the demands in a comment.

👉 The lack of transparency surrounding this letter is astonishing, almost as astonishing as companies' lack of courage to stand by their own views.

===

I put the full list of signatories into a comment.

16-10-2025

In several smaller Member States, only a handful of companies would still be required to report. Germany will still have the largest CSRD population, covering roughly 1,600 companies.

Across the EU as a whole, approximately 6,000 companies would fall under the revised CSRD if all subsidiaries would report (i.e. the subsidiary exemption is not used at all). However, in practice, the numbers will be even lower as, of course, the exemption will be used.

If we assume that 30% of subsidiaries report, the number drops to around 4,700 companies - and if no subsidiaries report, just over 4,200 companies throughout the EU would remain in scope.

👉 Bottom line: The CSRD landscape across Member States is about to change significantly. As fewer companies remain in scope, the debate on the business value of voluntary reporting becomes increasingly crucial.

15-10-2025

🔹 “The scope is well-balanced.”

Mr Warborn said: “I think we have a very good balance with the scope that we have in CSRD now.” The assumption: exempting 90% of companies strikes the right equilibrium between simplification and information needs. The reality: investors, businesses, academics, and the ECB have warned that such a narrow scope (even much below the NFRD) undermines the availability of sustainability information.

🔹 “Voluntary action will fill the void.”

When asked about the lack of data available to investors, Mr Warborn replied: “There is always a voluntary possibility for companies, that would like to have the capital, to provide information.” But voluntary sustainability reporting cannot fill systemic information gaps. You cannot regulate by wishful thinking...

🔹 “Plans without actions work.”

On climate transition plans, he said: “You have to show that you have them, but not what you actually need to do.” In other words, companies must adopt a plan, but not include implementation measures. That turns transition plans into box-ticking exercises, not tools for real change. Having a transition plan without actions is a bit like cooking with a recipe but without ingredients.

🔹 “Corporate complaints weigh more than accountability.”

Mr Warborn argued that one reason to drop EU-wide civil liability was because “you had complaints by companies and a lot of resistance for investing in Europe.” Apparently, corporate discomfort outweighs citizens’ right to a harmonised and strong EU-wide civil liability regime.

👉 These four assumptions are deeply problematic. They show why the current “simplification” debate risks misleading both businesses and citizens. Again: simplification itself isn’t the issue. It’s the kind of simplification being pursued, and the assumptions behind it.

14-10-2025

Good that there is finally more clarity. For many businesses the lack of certainty and predictability was/is a significant problem that holds back action and investments.

👉 But let’s be clear: this “compromise” didn’t emerge from consensus, but from the EPP’s threat to partner with the far right That kind of political brinkmanship undermines trust and poisons cooperation in the Parliament.

Flirting with the far right to pressure democratic partners is not responsible leadership. It is short-term power politics that risks eroding the democratic values the European Parliament is meant to uphold.

===

❗ I discuss the details of the Parliament's comprise with Richard Howitt and Julia Otten (Responsible Companies, Frank Bold) - thanks to both for the great conversation: https://lnkd.in/djgRc7bU

13-10-2025

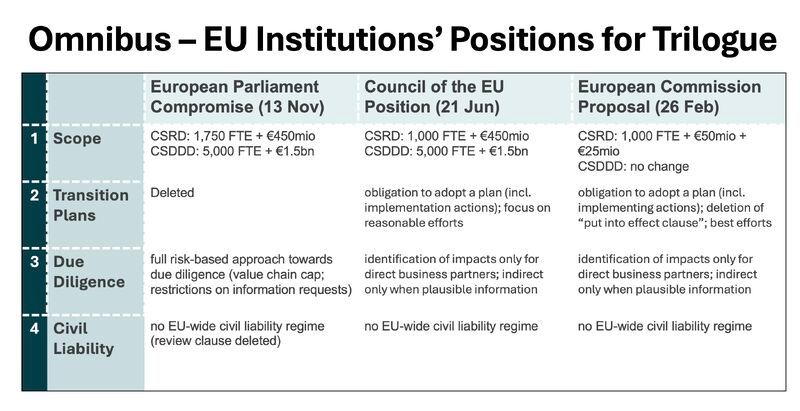

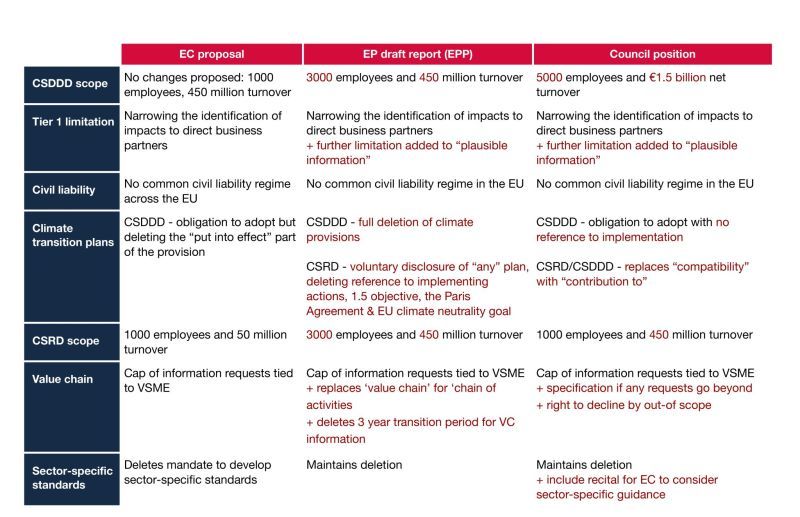

🔍CONTENT:

The comparison below (prepared by Responsible Companies, Frank Bold) summarises the three existing institutional positions: Commission, Council, and Parliament. Key takeaways:

1️⃣ Scope: Both co-legislators (Parliament and Council) largely align on the scope of the #CSRD and #CSDDD. The Commission’s proposal differs, but given its limited role in the trilogue, major changes on this point appear unlikely.

2️⃣ Approach to Due Diligence: The Parliament shifts further towards a fully risk-based approach and adds stricter limits on information requests. The trilogue will need to fine-tune scoping and assessment obligations.

3️⃣ Climate Transition Plans: All institutions agree that companies should adopt plans, the previous requirement to “put them into effect” has been deleted. The Parliament also proposes to delete the obligation to detail “implementing actions” within the plans, while the Council retains it.

4️⃣ Civil Liability: All institutions agree to remove the EU-wide civil liability regime - a significant retreat for corporate accountability.

🏛️PROCESS:

The Legal Affairs Committee (JURI) votes today, followed by a plenary vote next week. If both votes endorse the compromise text (which is likely), trilogue negotiations will begin.

Trilogues are informal negotiations between the Parliament, Council, and Commission aimed at reaching a provisional political agreement. The Commission acts primarily as facilitator and advisor, while the co-legislators take the lead. For the Omnibus package, the final trilogue session is currently scheduled for 8 December (subject to change).

10-10-2025

This reads a bit like: “We acknowledge that deregulation is underway, but it’s not enough. If you 'really' want to deliver, scrap it entirely.”

The letter - signed by the CEOs of TotalEnergies and Siemens on behalf of all 46 CEOs - stands in striking contrast to both companies’ commitments under the United Nations Global Compact. Calling for the repeal of mandatory due diligence rules is fundamentally incompatible with the Compact’s ten principles.

Dated 6 October, the letter emerged from the annual Franco-German business leaders’ meeting in Évian. It shows that even after the CSDDD was heavily watered down (now likely to cover only around 1,000 group companies post-Omnibus), some of the few remaining in scope are still pushing for more.

===

Reuters: https://lnkd.in/dgDCeixN

09-10-2025

The case examines the immediate implications of the Omnibus for #CSRD reporting. It tells the story of DEIF, a Danish mid-sized company that chose to keep reporting, not because it had to, but because it saw strategic value in transparency.

The case can be used in teaching settings (e.g., business schools), but it can (and should!) also be used by companies seeking to reflect on the broader implications of scaling back reporting regulation.

👉 Understanding why and how companies choose to act in the context of the Omnibus is a learning opportunity, and we should treat it as such - despite all the disappointment about the regulatory rollback.

Many thanks to my brilliant co-author Sven Beyersdorff as well as to DEIF for collaborating with us on this project.

===

🔍 Read it now: https://lnkd.in/diSRN-B8

09-10-2025

It is good to have a deal as this reduces uncertainty (see image for details). But the message is very troubling: threats now seem to be the regular way of handling things within the "von der Leyen majority".

The final outcome feels less like consensus and more like capitulation. Lara Wolters, S&D’s lead on the omnibus file, resigned as negotiator in protest.

👉 Companies with fewer than 1,000 employees can now be confident that they will be exempted from #CSRD, as the Commission, Council, and Parliament align on this threshold. Open question: will €450 million really hold as the final cut-off, as the Commission proposes €50 million?

The 5,000 employee and €1.5bn cut on #CSDDD is unacceptable - this makes due diligence only relevant to a few very large companies, and even these very few will face no common civil liability regime (all three institutions agree on this).

❗ This deal may bring closure - but at a very high cost for sustainability and for the credibility of the "von der Leyen majority" in the Parliament.

===

📅 Next steps: vote in the Legal Affairs committee (JURI) on 13 Oct; then a plenary vote in the Parliament the week after. This is followed by the trilogue negotiations in November and December to negotiate a final legal text.

08-10-2025

Today, the plan to potentially side with the far right has surfaced as a voting list which built upon the EPP’s compromise proposal with the far right. This proposal between the EPP and far right political groups reflects these points, but very important to note that the word has not been spoken yet and the negotiations are ongoing, so we still might see a different compromise:

1️⃣ Scope: CSRD: 1,750 employee cut + EUR 450 mio net turnover (-92%); CSDDD: 5,000 employee cut + EUR 1.5 bn turnover (-70%)

2️⃣ Climate Transition Plans: deletion in CSDDD; original text in CSRD retained

3️⃣ CSDDD Due Diligence Approach: fully risk based approach (with value chain cap at 5,000 employees)

4️⃣ Civil Liability: no EU-wide civil liability regime

Of course, technically speaking, these points can still be changed and negotiations are still ongoing. But, for this to happen we would need to see a real change of direction and a real willingness to compromise...

By siding with far-right groups, the EPP would take the easy way out – a move that reveals both internal pressure and a lack of willingness to work towards suitable compromises. It would imply to chose short-term political expediency over long-term responsibility.

👉 Europe’s citizens deserve leadership that safeguards their future, not bargains it away. By threatening to side with the far-right, the EPP shows that it is unable to deliver such leadership. The political parties in the centre should now really get their act together and work on a compromise that reflects the centre.

Fingers crossed that such a turn of events can be avoided. It would neither be good for democracy nor for sustainability...

===

News story: https://lnkd.in/dbhjBCp4

08-10-2025

1️⃣ ISSUES: Greenwashing tied to biodiversity has tripled. As pressure mounts to appear “nature-positive,” too many companies are responding with vague promises instead of verifiable plans.

2️⃣ SECTORS: Banking & Financial Services is the sector with the most companies linked to greenwashing risk (followed by Retail and Food & Beverage).

3️⃣ PERSISTENCE: Greenwashing is becoming a recurring feature of business conduct in some sectors: nearly 7 in 10 airlines flagged in 2024 were flagged again in 2025. The automotive sector shows similar patterns.

👉 Greenwashing isn’t fading — it’s evolving. EU Regulators must stay the course. Now is not the time to water down or scrap the EU Green Claims Directive...

===